This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

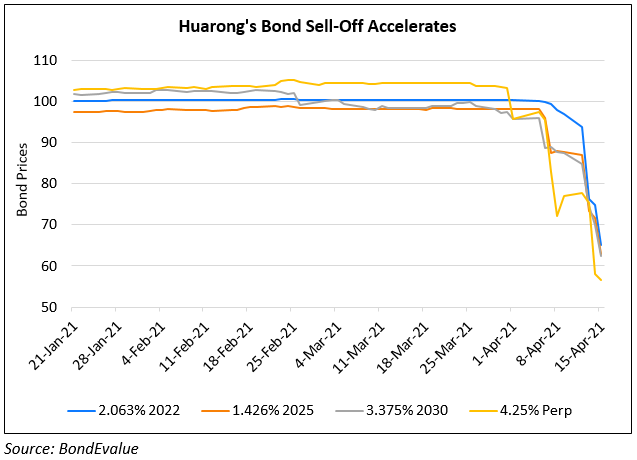

Huarong Wires $978mn For Maturing 3.25% Bonds Due June And Local Bond

May 31, 2021

China Huarong wired $978mn for its maturing bonds, the biggest bond payment since investor confidence in the company’s financial health fell. The asset manager said that it has wired $900mn for their 3.25% bonds due this Thursday, June 3 and another CNY 500mn ($78mn) for a local bond that matured on Sunday. Sources earlier this month said that Huarong reached funding agreements with state-owned banks to ensure it can repay debt through at least the end of August. The company has $700mn in offshore bonds maturing in July 2021 and a sizeable $3.3bn debt maturing in November 2021 including $1.4bn of offshore debt. Huarong expects to publish its financial statements by end-August.

Huarong’s bonds were stable to higher – its USD 3.75% 2024s were up 0.5 to 69.8 and its USD 5.5% 2047s were up 1 point to 65, yielding 9%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: