This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Huarong Upgraded to BBB+ from BBB by Fitch

February 24, 2022

China Huarong was upgraded to BBB+ from BBB by Fitch. Its senior unsecured bonds issued by Huarong Finance II Co., Huarong Finance 2017 Co. and Huarong Finance 2019 Co. were upped to BBB+ from BBB. Its 2017 Perps were upgraded to BBB- from BB+ and its 2019 Perps to BB from BB-. The upgrade follows the completion of Huarong’s recapitalization and Fitch’s reassessment of extraordinary support expectations. The MoF and CITIC Group (also under the MoF’s control) have a combined 51.22% shareholding in Huarong. Fitch considers the limited recurring extraordinary financial support and funding from state-owned banks to be moderately supportive. It considers the socio-political and financial implications of default as strong and hence the company plays a major role to the AMC industry and government as a whole. With Huarong’s liquidity and debt structure now stable, coupled with access to domestic funding, its capital raising and repayment risks are mitigated.

Huarong’s 3.375% 2030s traded 1.5 points lower to 86.08 yielding 5.56%.

Go back to Latest bond Market News

Related Posts:

Huarong Downgraded by S&P to BBB

September 9, 2021

Huarong Downgraded Three Notches To BBB By Fitch

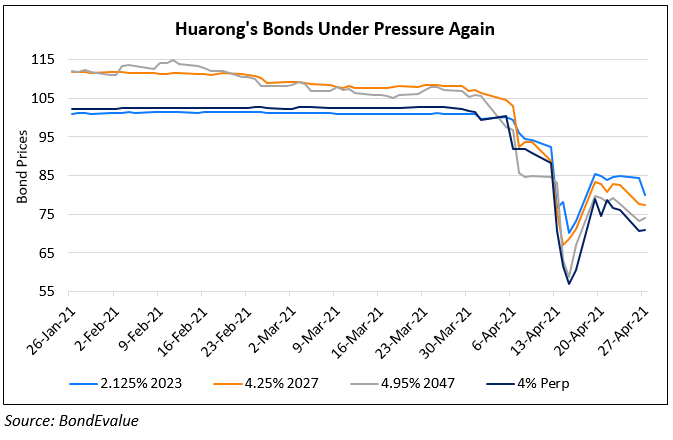

April 27, 2021