This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Huarong Says Rating Downgrades “Have No Factual Basis”; Has Ample Liquidity

May 3, 2021

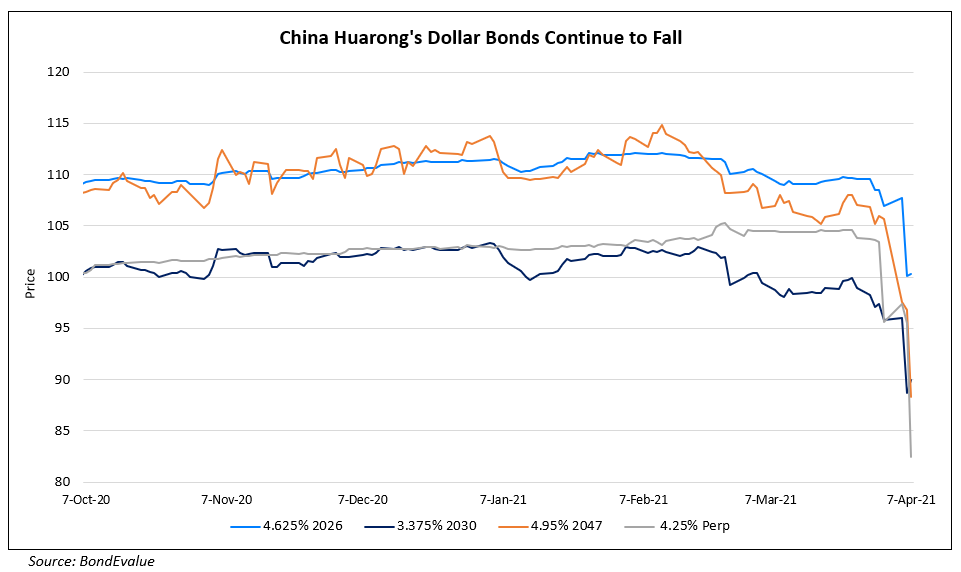

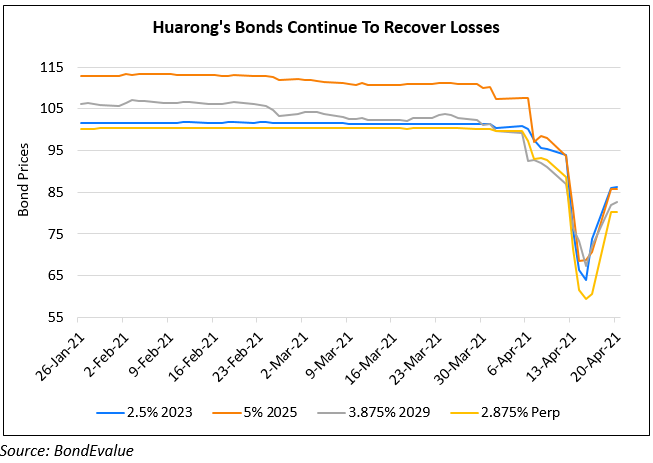

China Huarong’s vice president Xu Yongli said that there was no factual basis for the credit rating downgrades by rating agencies last week and asserted that the company is well prepared to make bond payments. According to Xu, the company has adequate liquidity to pay its debt and has already repaid the principal and interest on both onshore and offshore bonds due in April. The company, which holds a total offshore debt of $22.9bn, has delayed the release of its 2020 results causing panic among its creditors. The credit rating agencies sounded alarm bells last week when Fitch downgraded the company by three notches to BBB from A on April 26 followed by Moody’s that downgraded the company to Baa1 from A3 on April 29. According to Xu Yongli, “The decision on a rating downgrade is too pessimistic and the judgement lacks factual basis.”

Most of Huarong’s dollar bonds traded lower with its 3.25% 2024s and 3.375% 2030s down 1.25 and 1.44 to trade at 77 and 73.56 cents on the dollar respectively.

For the full story, click here

Go back to Latest bond Market News

Related Posts: