This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Huarong Reports $15.9bn Loss Warning; To Get State-led Bailout; No Plans to Restructure Debt

August 19, 2021

China Huarong came out with a profit warning and a press release on Wednesday, in an update regarding its 2020 financial results that investors have been keenly awaiting since March. Below is a brief of the talking points and details offered by Huarong as mentioned on their website.

Talking Points |

Description |

Profit Warning (Jan-Dec 2020) |

2020 Net loss of CNY 102.904bn ($15.9bn) vs. CNY 1.424bn ($220mn) profit in 2019 |

Reasons for Losses |

|

Operating Status |

|

Bond Payments and Liquidity Impact |

|

Asset Quality after Large Provisioning |

|

Next Steps |

Chemical insurance disposal collections, tap value of stock assets, speed up disposal and reduce ultimate loss |

Strategic Investment and Business Strategy |

|

“This is clearly a good signal that SOE support is still firmly in place when financial stability is at risk… For financial systemically important issuers, I think the notion of being too big to fail holds more than for property developers, for example”, said Kamil Amin, a credit strategist at UBS Group AG, referring to state- owned enterprises.

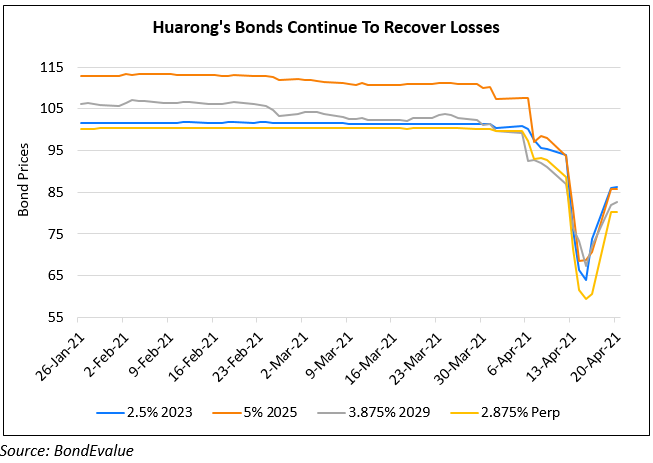

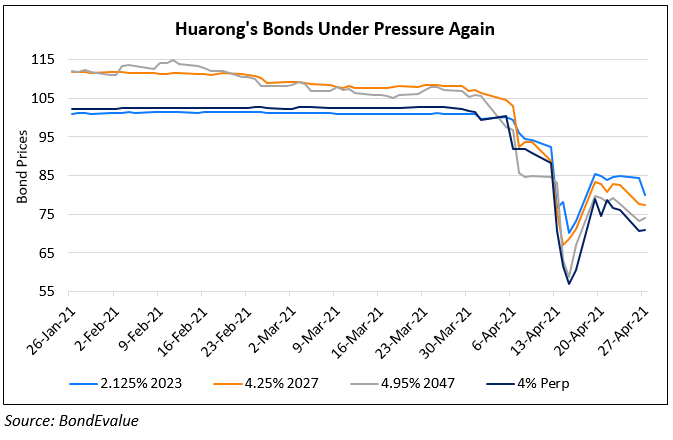

Huarong’s dollar bonds rose yesterday by 4-6%. Its 3.375% 2030s were up 6.2% to 80.5 and its 4% Perps were up 5.8% to 85.8.

For the full story, click here

Go back to Latest bond Market News

Related Posts: