This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Huarong Financial Leasing Affirmed at BBB-; On RWN

June 1, 2021

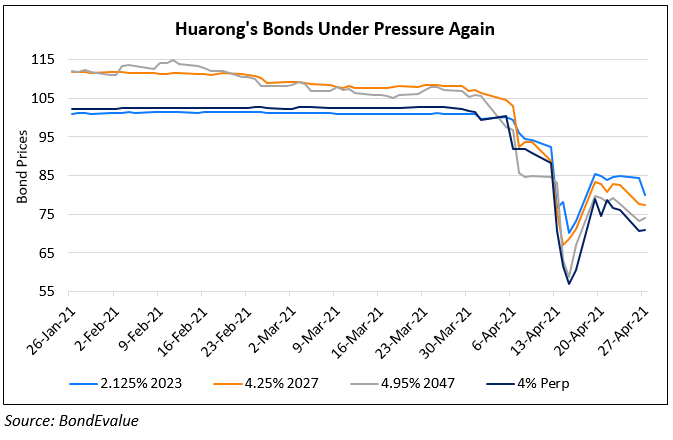

Huarong Financial Leasing Co Long-Term Issuer Default Rating of BBB- was maintained and placed on Rating Watch Negative (RWN) by Fitch in line with the ultimate parent, China Huarong Asset Management Co. Huarong Leasing Management Hong Kong Company’s $1bn notes were also maintained on RWN. The rating agency said that Huarong Financial Leasing was not considered a core subsidiary of China Huarong as it supports its own profitability and does not have a significant role in the core business of China Huarong. However, they added that a weakening in China Huarong’s credit profile could weigh on Huarong Financial Leasing. Fitch considers the financial leasing company’s standalone credit profile to be non-investment grade based on the “operating environment, a modest franchise, weak profitability and high level of leverage”. The company had reported net profits of CNY 1.6bn ($239mn) for 2020 and its outstanding bonds due by end-2021 amount to CNY 4.3bn ($666mn) including $300mn bonds due next month. According to the rating agency, “The China Banking and Insurance Regulatory Commission’s regulations, as well as Huarong Financial Leasing’s articles of association, also require China Huarong to provide liquidity and capital support to Huarong Financial Leasing, if needed”. The company’s ratings were downgraded 3 notches to BBB- from A- on April 27 this year, a day after China Huarong was downgraded to BBB and a reassessment of government-support factors.

Huarong Leasing’s 1.9% 2022s were up 1.61 points at 87.8 while its 2.5% 2021s were down 0.31 to trade at 95.95 cents on the dollar.

For the full story, click here

Go back to Latest bond Market News

Related Posts: