This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Huarong Expected To Sell Non-Core, Loss-Making Units To Avoid Restructuring; Allegedly Well Received

April 9, 2021

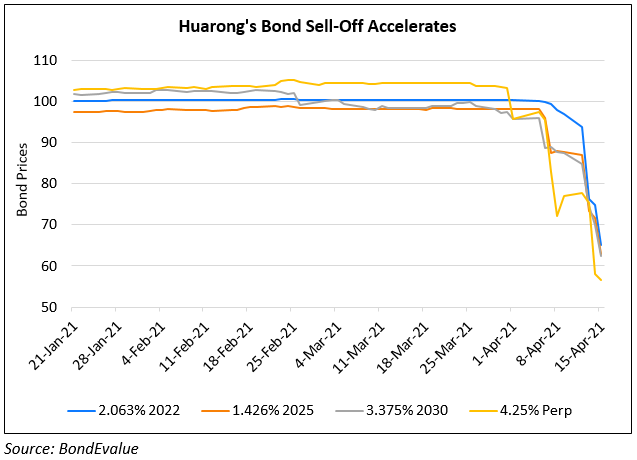

China Huarong Asset Management is planning to offload non-core and loss-making units to revive profitability and avoid the need for financial restructuring or government bail-out. Bloomberg sources say that Huarong is determining the value of its stakes in some onshore and offshore units and finalizing which ones will be sold. They added that this was part of the reason why it delayed its earnings. Bloomberg notes that immediately after the above news, its USD 4.5% Perp jumped ~10 cents to ~93.5 cents on the dollar. The Perp is currently 1.9 cents lower at 91.6, yielding 16.4%. While the regulators like CBIRC did not respond immediately for any comments, the plan has been well received according to a source. Huarong’s bonds have been falling for over a week ever since they delayed their earnings release and on reports of restructuring.

Huarongs dollar bonds are trading mixed, with some lower and other higher. Its 2.063% 2022 is down 1.1 to 94.9 while its 3.75% 2022s and 4.95% 2047s are up 1 point to 95 and 85.54 respectively.

For the full story, click here

Go back to Latest bond Market News

Related Posts: