This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

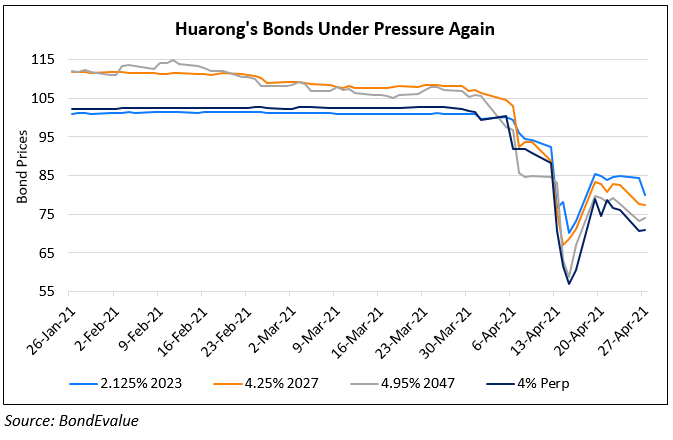

Huarong Downgraded by S&P to BBB

September 9, 2021

China Huarong Asset Management Co. and China Huarong International Holdings Ltd. have been downgraded by S&P to BBB from BBB+ and subsidiary China Huarong Financial Leasing Co. Ltd. (Huarong Financial Leasing) has been lowered to BBB- from BBB+. The rating outlook is negative. The action has been taken reflecting S&P’s view that “leverage is still under pressure, given uncertainties over its recapitalization and asset disposal plan, in addition to falling regulatory barriers to entry for the distressed asset management sector”.

Huarong’s asset quality remains weak with a high proportion of stage 2 and stage 3 assets (debt instruments at amortized costs), which surged to 41% at end-2020 from 22% at end-2018 with a possibility of deteriorating further. At end-2020, average provisioning for these assets were at 6% and 57% respectively. Looking at its delayed released results that saw substantial credit impairment and fair value markdowns, their equity base eroded substantially and remains weak. Its capital adequacy ratio stood at 4.16% at end-2020 and 6.32% at end-June 2021, significantly below the minimum regulatory requirement of 12.5%.

S&P expects Huarong to meet capital requirements after recapitalization by potential strategic investors, but its core business is likely to remain weak. They expect the “Chinese government to continue to control the group to avoid triggering the change-of-control clause in its offshore bonds”. On the positive side, S&P expects Huarong to maintain adequate funding and liquidity, supported by its good relationship with domestic banks. They add that they see a potential strategic investment by central government-owned investors (backed by the MoF) as an indirect form of government support. On August 23, Moody’s downgraded Huarong’s to Baa2 from Baa1 and kept them on review for downgrade, while Fitch revised Huarong’s rating watch to positive from negative while maintaining its rating at BBB.

Huarong’s dollar bonds were lower – its

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Huarong Downgraded Three Notches To BBB By Fitch

April 27, 2021

Huarong Announces EGM on August 17

July 2, 2021