This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Huarong Downgraded By Moody’s To Baa1; Ratings Remain Review For Downgrade

April 29, 2021

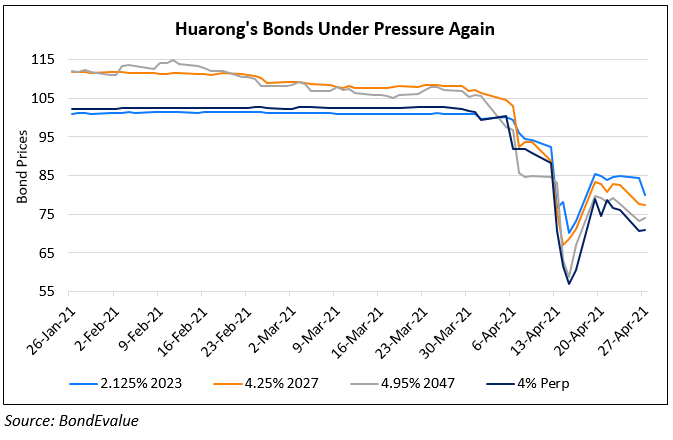

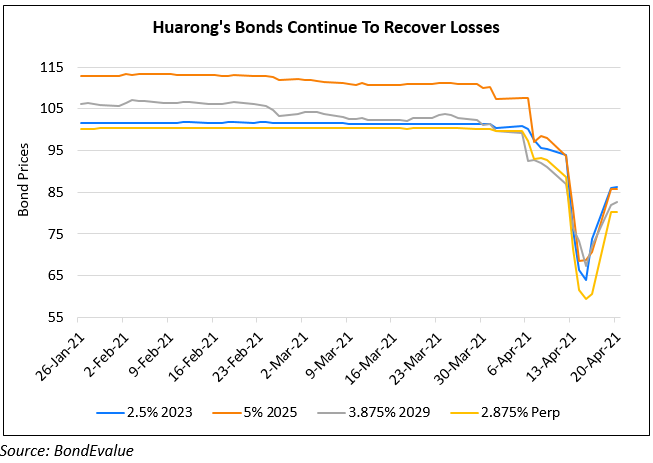

Rating agency Moody’s downgraded China Huarong to Baa1 from A3 and its Baseline Credit Assessment (BCA) to b2 from b1. Moody’s also downgraded the long-term backed senior unsecured debt ratings of Huarong AMC’s offshore financing vehicles to Baa2 from Baa1. They added that the ratings remain on review for a downgrade. The downgrades reflect a weakened funding profile due to market volatility and heightened uncertainty surrounding the company. They highlighted the uncertainty levels of government support, governance weakness, weakening investor sentiment and material credit and market risks relating to its legacy assets as some factors affecting the rating. Moody’s said that their expectations that government support will flow through the onshore parent to offshore securities is due to ‘keepwell deeds’, though it isn’t any explicit guarantee.

Moody’s becomes the second rating agency to downgrade Huarong after Fitch initiated the downgrade a couple of days ago by three notches to BBB. Moody’s also said that it is unlikely that they will be upgraded in the next 12-18 months.

For the full story, click here

Go back to Latest bond Market News

Related Posts: