This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

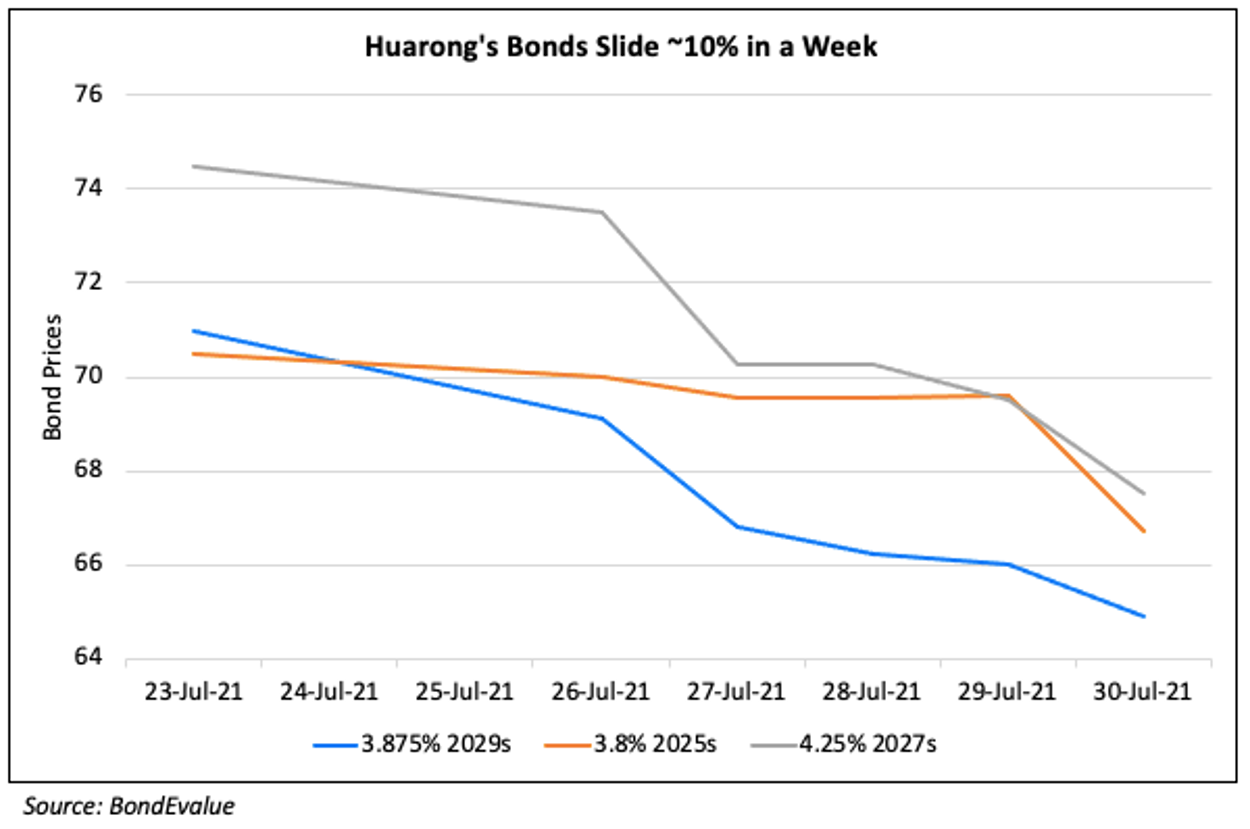

Huarong Dollar Bonds Slip on Moody’s Review for Downgrade

March 23, 2023

Dollar bonds of China Huarong AMC fell by ~1 point after Moody’s placed its Baa2 ratings under review for downgrade. This comes after the company warned of a loss of RMB 27.6bn ($4bn) for 2022 citing erosion in fair values of some of its equity assets and credit impairment losses due to capital market volatility. The rating agency said that it highlights weakness in risk management, a key driver of the rating action. The large net loss has eroded the asset manager’s weak equity base and capital positions. Its profitability and asset quality are set to face a strain due to the property market slowdown and overall volatility.

Huarong’s dollar bonds were trading lower with its 4.5% 2029s down over 1.4 points to 70.63, yielding 11.22%.

Go back to Latest bond Market News

Related Posts: