This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Hopson to Buy 51% in Evergrande Property Services for $5bn as per Sources

October 4, 2021

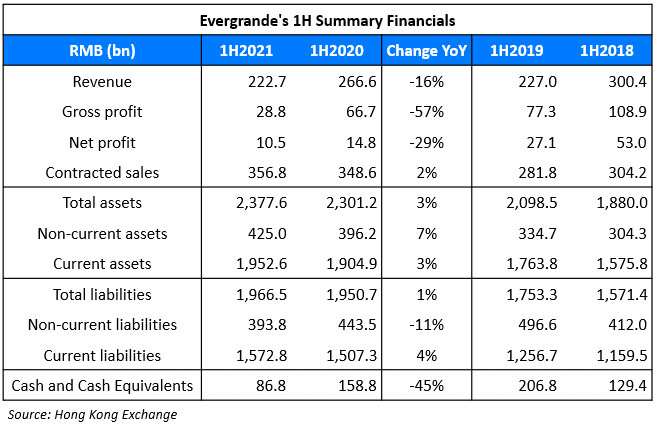

Hopson Development plans to acquire a 51% stake in Evergrande Property Services for over HKD 40bn ($5.1bn) as per sources cited by Cailian news. Evergrande’s Property Services unit has a market cap of HKD 55bn ($7bn). As of end-June 2021, the unit had cash balances (including restricted cash) of RMB 14bn ($2.18bn), short-term liabilities of RMB 9.9bn ($1.5bn) and long-term liabilities of RMB 870mn ($135mn). For 1H2021, the unit reported gross profits of RMB 2.9bn ($450mn), up 68.7% YoY and net profits of RMB 1.9bn ($290mn), a 68.6% YoY increase. Hopson is rated B2/B+ (Moody’s/Fitch).

Evergrande’s dollar bonds were trading stable – its 9.5% 2022s were up 0.3 to 25.7 and its 8.75% 2025s were up 0.4 to 24.7.

Meanwhile shares in Evergrande and its unit were suspended from trading.

Go back to Latest bond Market News

Related Posts:

Evergrande Cuts Borrowings by 10% to $109 Billion

April 1, 2021

China Evergrande Warns of Default Risk & Rising Litigation Cases

September 1, 2021