This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Hong Kong Launches $ Green Deal; Macro; Rating Changes; New Issues; Gainers and Losers

May 31, 2023

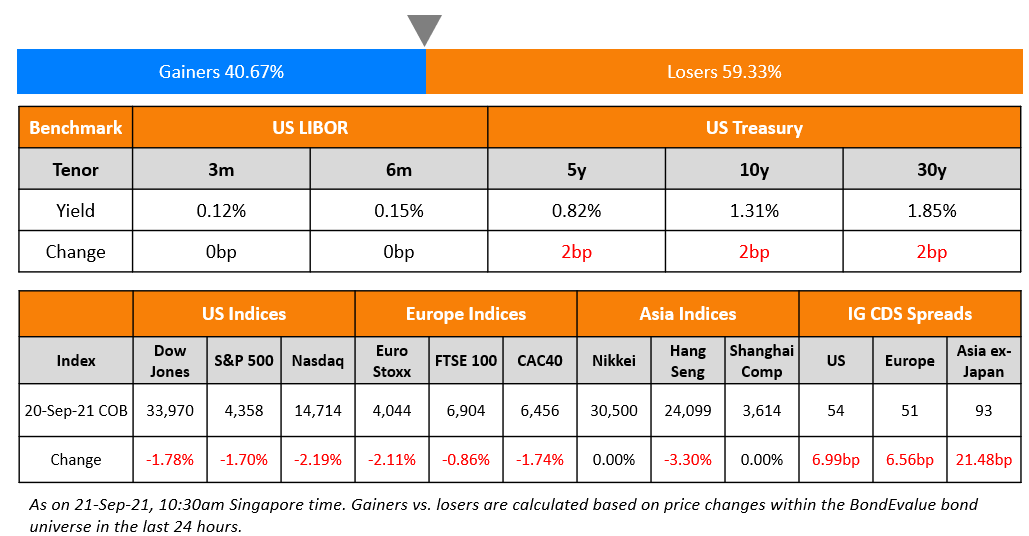

2Y and 5Y Treasury yields fell 11-13bp at close of the first US trading session this week, reacting to positive news on the debt ceiling limit that came during the long weekend. The US House Rules Committee, which controls the floor debate, voted 7-6 to advance the debt ceiling extension bill. Markets now await a Wednesday evening vote before the full House.

Markets continue to price in a 60% chance of a 25bp rate hike in June as per CME probabilities. The peak Fed Funds Rate was 1bp higher at 5.31% for July. S&P closed unchanged while Nasdaq gained 0.3% thanks to chipmaker stocks like NVIDIA that continue to rally on the anticipated surge in demand for AI applications. US IG and HY CDS spreads tightened 1.1bp and 7.1bp respectively.

European equity indices closed lower. European main CDS spreads widened 0.2bp and Crossover spreads were 1.7bp wider. Asia ex-Japan CDS spreads saw a 3.7bp tightening and Asian equity markets have opened in the red this morning.

Exclusive Event for BondEvalue Subscribers in Dubai | 19 June

New Bond Issues

- Hong Kong $ 3Y/5Y/10Y Green at T+65/70/80bp area

HSBC raised S$600mn 6NC5 bond at a yield of 4.5%, 25bp inside initial guidance of 4.75% area. The senior bonds are rated A3/A–/A+, inline with the issuer. If the bonds are not called after five years, the coupon reset to the 1Y SORA-OIS plus the initial spread of 149.2bp. The deal received orders of S$880m, 1.5x issue size. Singapore investors took 94% of the deal with others taking the remaining 6%. Fund managers were allocated 42%, private banks 35%, insurers and pension funds 14%, and banks and corporates 9%. Proceeds will be used for general corporate purposes.

SocGen raised €2.25bn via a two-part deal. It raised €1.25bn via a 4Y senior preferred bond at a yield of 4.127%, 30bp inside initial guidance of MS+125bp area. The bonds have expected ratings of A1/A/A, and received orders over €2.1bn, 1.7x issue size. It also raised €1bn via a 10Y Tier 2 bond at a yield of 5.695%, 30bp inside initial guidance of MS+300bp area. The bonds have expected ratings of Baa3/BBB-/BBB, and received orders over €3.2bn, 3.2x issue size.

First Abu Dhabi raised $600mn via a 5Y Green bond at a yield of 4.774%, 25bp inside initial guidance of T+120bp area. The senior unsecured bonds have expected ratings of Aa3/AA-/AA-, and received orders over $1.4bn, 2.3x issue size. Proceeds will be used to finance/refinance Eligible Green Projects inline with FAB’s Sustainable Finance Framework. The new bonds are priced 10.4bp wider to its existing non-green 4.375% 2028s that yield 4.67%, implying a negative greenium (Term of the Day, explained below) for the new 5Y bonds.

Sabadell raised €750mn via a 6NC5 Green bond at a yield of 5.111%, 30bp inside initial guidance of MS+230bp area. The senior preferred bonds have expected ratings of BBB/BBB (S&P/Fitch), and received orders over €1.8bn, 2.4x issue size. Proceeds will be used for green eligible projects as described in the Issuer’s SDG Bond Framework.

AT&T raised $2.75bn via a long 10Y bond at a yield of 5.442%, 35bp inside initial guidance of T+210bp area. The bonds have expected ratings of Baa2/BBB/BBB+. Proceeds will be used to fund an early redemption of the outstanding $750mn floating rate notes due 2024 and to repay, together with cash on hand, its outstanding 0.900% notes due 2024.

New Bonds Pipeline

- BGK hires for $ 10Y bond

- GS Caltex hires for bond

Rating Changes

-

Fosun International Outlook Revised To Stable On Deleveraging Progress; ‘BB-‘ Ratings Affirmed

Term of the Day

Greenium

Greenium is a term that refers to the premium that investors pay when buying green bonds vs. conventional non-green bonds. Green bonds that trade with a greenium indicate strong investor demand for those bonds, which pushes prices higher and yields lower compared to conventional bonds.

Talking Heads

On ECB Sounding Warning Over Waning Market Liquidity as Rates Rise

“These cyclical factors may have reached a turning point, potentially exposing the underlying risks that have been masked by accommodative policy over the last decade. It signals the heightened risk of a shift toward a stressed liquidity regime”

On The Hedge Fund That Sees a Sweet Spot in 5-Year Corporate Debt

“There’s an amazing opportunity for investors, generally speaking, in short-dated corporate bonds… you have to reinvest and yields are not going to be up there. They’re going to normalize back down to a lower level… you have more uncertainty around rate risk and credit risk for bonds beyond five years”

On Nigeria Bonds on Track for Biggest Gain in a Month

Patrick Curran, senior economist at Tellimer

“Tinubu has got off on the right foot with markets by promising to remove the fuel subsidy and unify Nigeria’s multiple exchange rates, implying a long overdue devaluation may finally be on the cards… remains to be seen if he will be able to follow through on his market friendly rhetoric.

Ayodeji Dawodu, BancTrust & Co

“The subsidy removal and rates unification instill confidence among both local and foreign investors… has been a key hindrance to the government on the fiscal side “

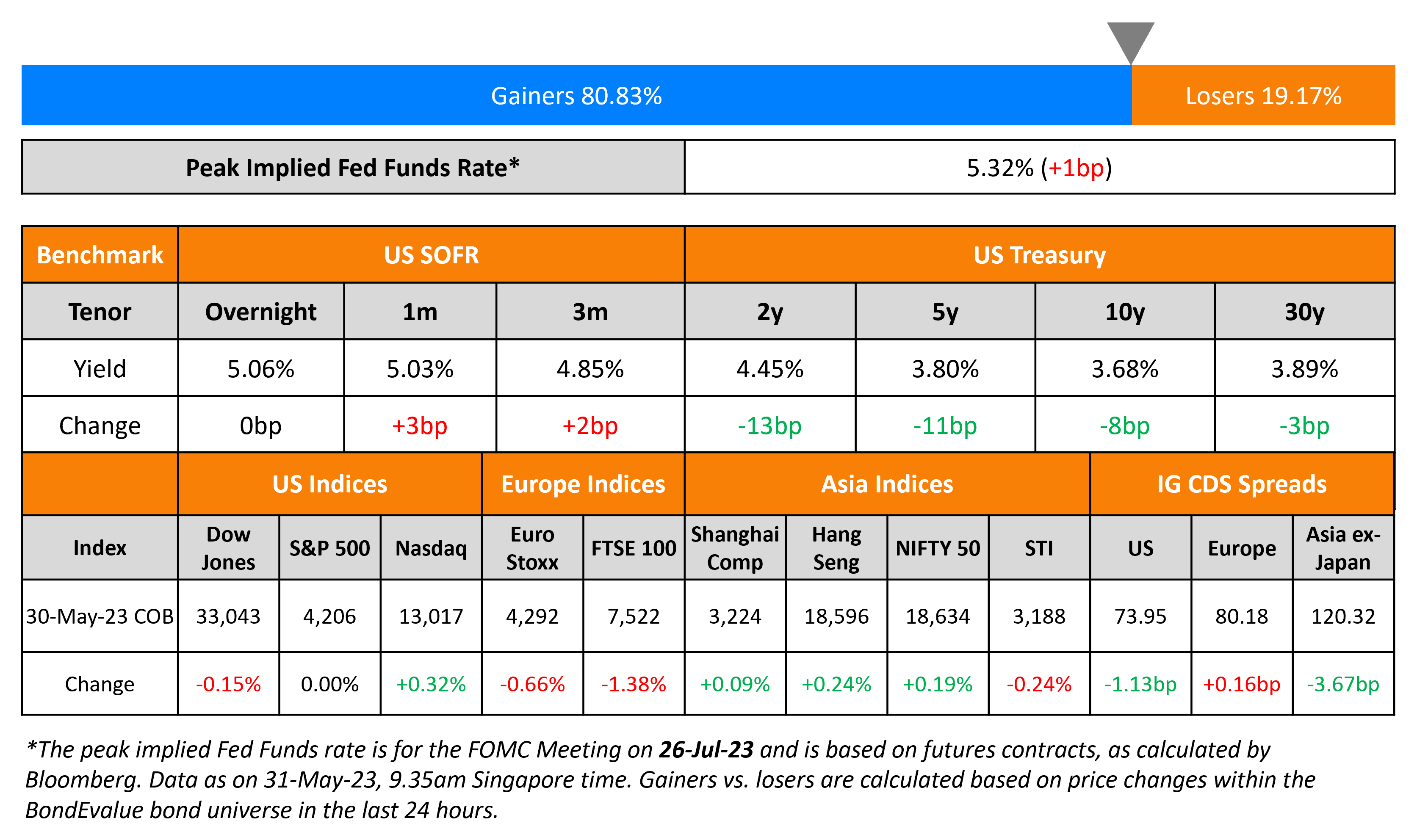

Top Gainers & Losers – 31-May-23*

Other News

Chilean Telco Bonds Surge as Slim’s America Movil and Malone’s Liberty Provide Funding

Go back to Latest bond Market News

Related Posts:-1.png)