This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

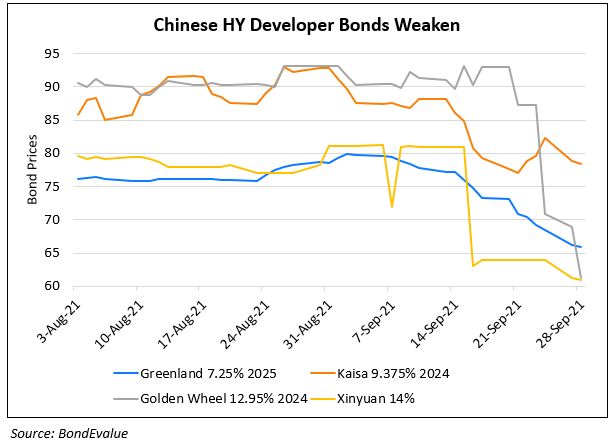

Greenland Downgraded to CC by S&P; COGARD on Review for Downgrade

May 31, 2022

Greenland Holding was downgraded for a second time in two weeks by S&P, by four notches to CC from B-. The company’s outstanding senior unsecured notes were also cut to C from CCC+. The downgrade comes on the back of the distressed maturity extension offer for its $488mn 6.75% dollar bond due June 25 by a year. S&P assesses that Greenland has limited cash to meet offshore maturities in the next one year that total $2.4bn. S&P notes that for bondholders who accept the offer, Greenland offers a repayment of 10% of the outstanding principle and accrued interest. In addition to the maturity extension, Greenland will also offer a 0.5-1.0% consent fee to bondholders who accept the offer. Once completed, S&P would consider the transaction as tantamount to default. The developer was downgraded to B- from B+ on deteriorating liquidity and cash depletion for debt repayment last week.

Separately, Country Garden’s Baa3 ratings were kept under review for a downgrade by Moody’s on expectations that its credit metrics will weaken due to a sales decline and that access to offshore funding will remain restricted over the next 12-18 months.

Go back to Latest bond Market News

Related Posts: