This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

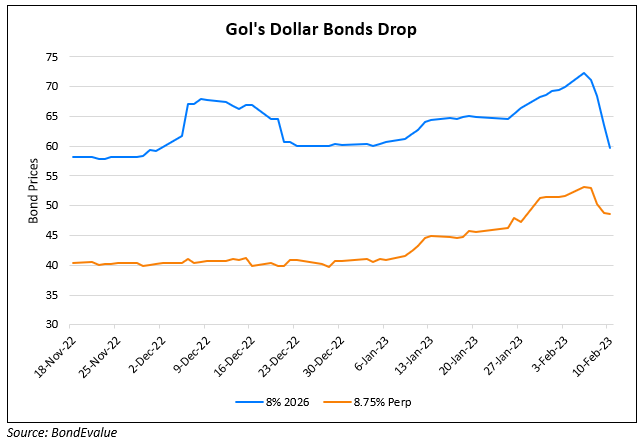

Gol’s Dollar Bonds Drop on Downgrade to CC by S&P

February 10, 2023

Brazilian low-cost carrier Gol’s dollar bonds were down as much as 6% after the company was downgraded to CC from CCC+ by S&P. This rating action came on the back of Gol’s debt refinancing plan that included a debt exchange of part of its offshore bonds below par and the extension of maturities until 2028. Upon closing the transaction, S&P view it as “a de facto restructuring and tantamount to default”.

On February 7, Gol announced that Abra Group (holding company that will hold controlling equity in Gol and Avianca) will fund the refinancing of Gol’s debt. Gol will privately place debt with Abra for at least $1bn through senior bonds being replaced by exchangeable senior notes due 2028. Some of Abra’s shareholders have agreed to invest ~$175mn in cash, and an ad-hoc group has agreed to invest $243mn in cash in Abra to support the transaction. Also, the ad-hoc group committed to tender back at least $680mn in face value of their Gol bonds to Abra at highly discounted prices. To complete the transaction, Abra requires that other bondholders participate in it providing at least additional cash for $82mn and deliver another $186mn in bonds. S&P notes that investors could receive as low as 35 cents on the dollar to up to 73 cents on the dollar if they participate in the funding.

Go back to Latest bond Market News

Related Posts:

Ronshine Downgraded by Moody’s to B2

September 17, 2021