This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Golden Wheel Reports 89% Drop in H1 Gross Profits

September 29, 2021

Chinese developer Golden Wheel Tiandi reported an 89% YoY drop in gross profits to RMB 13.3mn ($2.06mn) for 1H2021 with its gross margins falling massively from 29.1% to a mere 1.1%. The company attributed the poor results to its gross loss generated from the sale of developed properties as compared to a profit margin last year of 14.6% on the same. This was primarily due to one of the Group’s residential project in Nanjing making a loss of RMB 153mn ($23.7mn) resulting from the restricted selling price policy adopted by the local government as Golden Wheel had acquired that project just before the adoption of this pricing policy. It added that without this project, gross margins from the sale of completed properties would have been 12.7%. Its land acquisition costs and construction costs jumped 37.5% and 49.5% to RMB 462mn ($71.5mn) and RMB 609.9mn ($94mn) respectively. The Group incurred a net loss of RMB 77.2mn ($11.9mn), down 45% YoY.

Golden Wheel’s cash balances stood at RMB 1.98bn ($mn). Borrowings stood at RMB 2.9bn ($450mn) with its cost of borrowing rising 12% YoY. It reported a net gearing ratio (total borrowings net of cash and restricted bank deposits divided by the total equity) of 81.8% vs 95.6% during the same period last year.

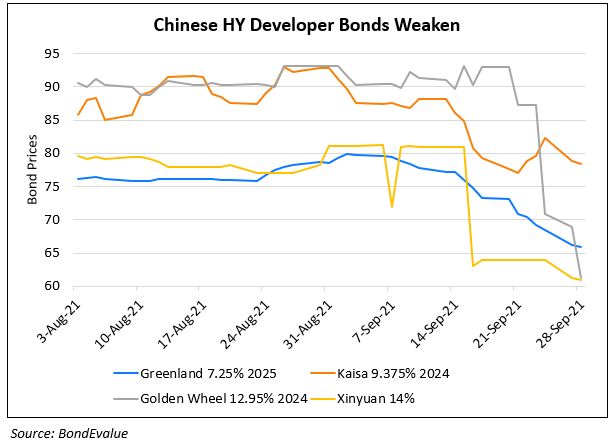

Golden Wheel’s bonds dropped sharply, with its 16% 2023s down 8.7 points to 52.12.

For its complete interim results, click here

Go back to Latest bond Market News

Related Posts:

Golden Wheel Tiandi Downgraded to CCC+

April 20, 2021

Other Chinese Developers’ Dollar Bonds Move Further Lower

September 28, 2021