This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

GMR Closes $100mn Dollar Bond Buyback; To Refinance Using Local Bonds

March 9, 2023

GMR Hyderabad’s buyback offer to purchase for cash up to $100mn of its 5.375% 2024s and its 4.75% 2026s received $179mn in tenders at the early deadline of March 6. As per IFR, GMR Hyderabad is planning to finance the buyback via a planned INR 8.4bn ($103mn) 10Y INR-denominated bond at 8.71%. Regarding the buyback offer, the 2024s tendered early will receive first priority, followed by the 2026s that were tendered early.

Its 5.375% 2024s and its 4.75% 2026s are trading at 99.59 and 93.89, yielding 5.77% and 7.13% respectively.

Go back to Latest bond Market News

Related Posts:

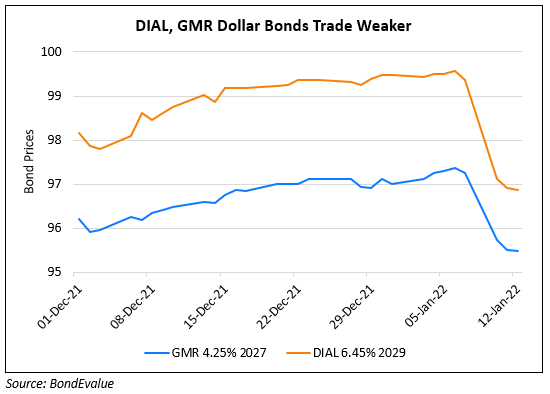

DIAL, GMR Airport Bonds Down 3-4 Points

January 12, 2022

GMR Hyderabad Buyback Tender Offer for 2024s and 2026s

December 5, 2022

GMR Hyderabad Accepts $139.125mn of 2024s, 2026s for Buyback

December 13, 2022