This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

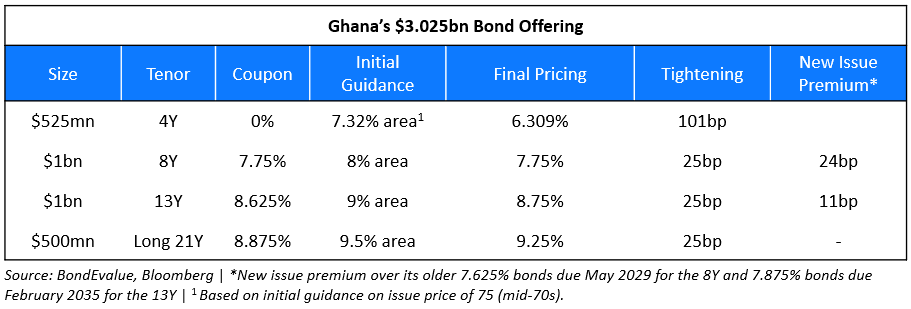

Ghana Raises Over $3bn via Four-Trancher

March 30, 2021

West African nation Ghana raised $3.025bn via a four-tranche bond offering priced on Monday. Details are mentioned above.

One of the four tranches is a zero coupon bond (Term of the day, explained below), Africa’s first as per Bloomberg. Mohammed Elmi, a portfolio manager at Federated Hermes Inc. said, “The zero-coupon bond is both novel and ambitious. It allows the sovereign to free up resources to spend on development expenditure, health care and education.” The new bonds are expected to be rated B3/B-/B in line with the issuer. While the 4Y zero coupon bond has a bullet payment at redemption, the 8Y, 13Y and Long 21Y amortize in three equal installments in the final 3 years of the respective bonds’ life. The sovereign plans to use proceeds to repay expensive domestic and external debt and to fund social spending related to the pandemic. A global hunt for yield has helped Ghana successfully sell new bonds despite its strained financial position, As per Fitch, debt servicing costs account for over 50% of Ghana’s government revenue, significantly higher than the median of 11% for similar rated sovereigns.

Go back to Latest bond Market News

Related Posts:

Ghana Lining Up $1bn of Sustainable Debt

May 28, 2021

Bank of Japan Tapers Purchases Prompting Bonds Sell-Off

September 23, 2018

Debut Green Bonds from The Netherlands Planned for 2019

November 2, 2018