This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

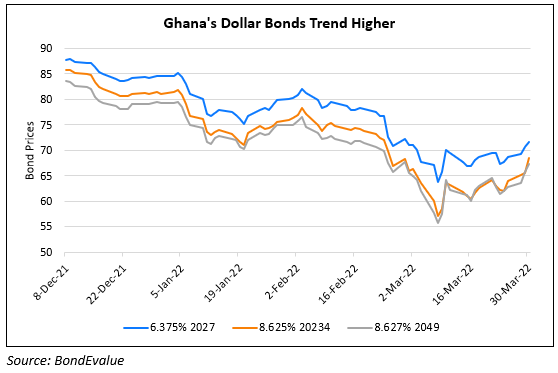

Ghana Proposes Up to 30% Haircut on Debt to Offshore Creditors

November 25, 2022

Ghana’s Deputy Minister of Finance John Kumah has proposed to ask its international bondholders to look at a 30% haircut on the principal and forgo some interest payments as part of its debt-sustainability plan to secure a $3bn IMF loan. It will also ask domestic bondholders to forgo some interest payments, the minister said. Kumah said that the government was looking to suspend coupons on foreign bonds for three years while domestic bondholders would be asked to exchange their existing bonds for a new bond that offer no coupons in the first year, 5% in the second and 10% in the third year. Ghana is trying to reach a staff-level agreement with the IMF by year-end. The latest update comes in stark contrast to Ghana’s President Nana Akufo-Addo who recently ruled out debt haircuts as part of negotiations. The nation has been subjected to downgrades from rating agencies with Moody’s downgrading them to Caa2 from Caa1 and Fitch planning to downgrade them to RD (restricted default) from CC if the debt restructuring takes place.

Ghana’s dollar bonds were trading higher by ~1 point – its 10.75% 2030s are at 70.4 cents on the dollar, yielding 17.9%

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Ghana President Rules Out Debt Haircuts as Part of Negotiations

October 31, 2022

Ghana Downgraded to Caa1 by Moody’s

February 7, 2022