This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ghana Plans to Seek ~$1.5bn from IMF as Talks Start

July 7, 2022

Ghana has sought around $1.5bn from the IMF to improve its finances and get access to global capital markets. Earlier this week, Ghana was learnt to have reversed its decision not to seek assistance from the multilateral lender. Finance Minister Ken Ofori-Atta said that after Moody’s cut Ghana’s rating in February to Caa1, the nation lost access to overseas capital markets and led to “inability to get the needed dollars, which created the balance of payment problems and a possible rundown” of reserves.” IMF’s support will give investors some relief on refinancing foreign debt. Ghana in a statement said that it will give a minimum 3-year plan to IMF for restoring debt sustainability and macroeconomic stability, build forex reserves to absorb economic shocks and strengthen the monetary policy of the central bank and build buffers against. In the last five years, Ghana’s debt-to-GDP has risen from 62.5% to 78% levels. Forex reserves have declined to $8.3bn as of April and inflation has shot up to 27.6% in May. With its need to also tackle inflation amid its financial conditions, the central bank May hiked rates by 200bp to 19%.

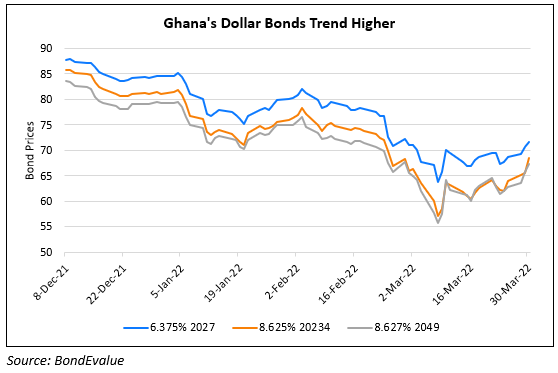

Ghana’s dollar bonds were trading lower with its 8.125% 2026 down over 0.64 points to 79.92 yielding 15.76%. In last week yield fell from 19.2% levels.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Ghana Downgraded to Caa1 by Moody’s

February 7, 2022

Banks Lend $1bn to Ghana to Boost Reserves

June 13, 2022