This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

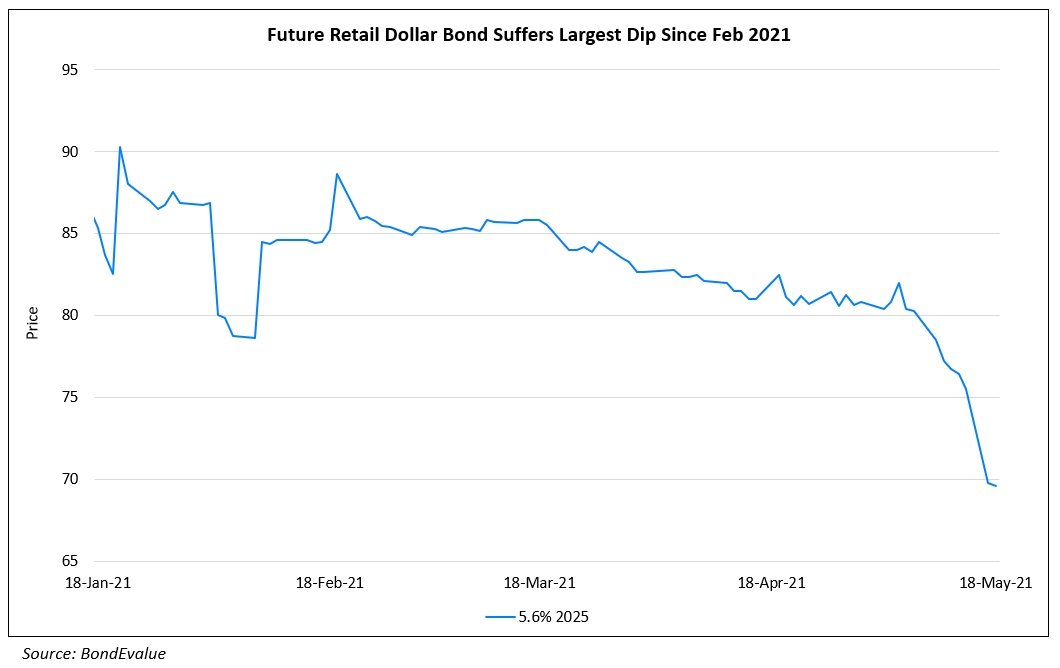

Future Retail’s Bonds Slip As Second Wave In India Ravages On

May 18, 2021

Future Retail’s 5.6% 2025s topped the loser’s list on Monday when it fell over 7% to 69.6 cents on the dollar, yielding 17%. This marks the dollar bond’s largest fall since February 2021 when the Indian High Court blocked Reliance Retail’s acquisition of Future Retail and Future Retail missed coupon payments for the second time.

The sharp drop in bond price comes as a second Covid-19 wave devastates India, and measures to stem the virus spread are disrupting supply chains and pushing prices higher. According to Sadashiv Nayak, CEO of Future Group’s flagship hypermarket chain Big Bazaar, the company plans to cope with the new reality by expanding into more cities and improving its omni-channel presence. On the company’s expected revenues, Nayak said, “the next two months are likely to be stable given there are no material changes to future economic conditions. Overall, we don’t see a major divergence in performance from the last quarter.”

For the full story, click here

Go back to Latest bond Market News

Related Posts: