This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

First High Yield Issue by Yum Brands After Weeks of Lull; Sri Lankan Bond Prices Lower

March 31, 2020

As the worst quarter for global equities since 2008 comes to a close, investors see some hope from the wide stimulus measures. The US and other developed markets continue higher in contrast with Asian and other emerging markets that are still struggling to find some ground and had mixed moves. Asian markets are opening slightly lower today but US index futures are opening higher. S&P and DJIA climbed 3.4% yesterday, and the Nasdaq climbed 3.6%. WTI crude rose 3.2% to $20.72 a barrel after plummeting 6% in the previous session.

Like any crisis, an outflow of funds from emerging markets to developed markets is natural as investors seek safer assets and prefer stocks and bonds of companies closer to home. Investment grade bonds in the US have found support as the initial wave of selling due to redemptions may have passed, and now with the facilities added by the Fed to get involved in both the primary and secondary markets for these names, some investors say there is good value here. It’s either this or issuers are using this opportunity and are rushing to raise as much cash as they can to prepare for what is yet to come.

First Junk Bond Issue in Weeks by Yum Brands

While investment grade companies are issuing debt in record amounts, the owner of fast food franchises KFC, Taco Bell and Pizza Hut became the first junk-rated company to raise fresh capital since early March. Deal size was increased by $100mn to $600mn as they looked to bolster cash in the face of a prolonged slow down. Demand was strong enough to bring down the cost from nearly 9% to 7.75%, but still high compared to 4.75% for a 10 year bond that Yum Brands sold last year. The average yield in the US junk bond market had risen from a six-year low of 5.1% in January to 9.5% on Friday.

For the full story, click here.

S&P says Asia Credit Conditions as bad as 1997

Even as normalcy returns to mainland China, the rise in Covid-19 cases in the rest of Asia-pacific is translating to an environment as challenging as the 1997-98 Asian Financial Crisis for borrowers, according to a report by S&P. Risks include virus containment failure affecting financing, commodity price volatility increasing and the potential US-China dispute re-igniting. Although low interest rates and stimulus measures provide relief, demand is likely to weaken as credit quality declines and defaults increase.

For the full story, click here.

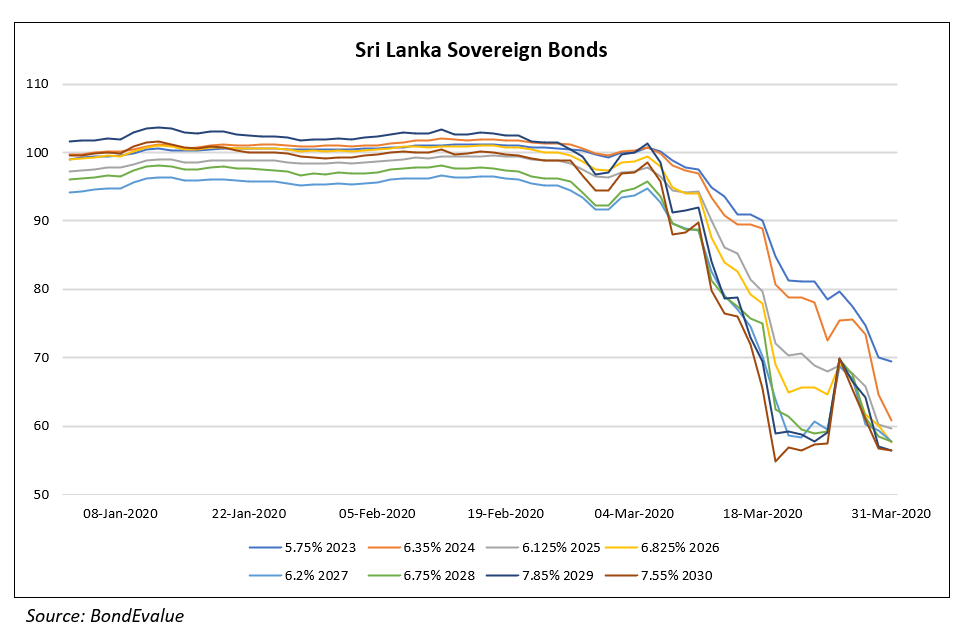

Sri Lankan Bond Yields Higher; FX Market Freezes Up

With stock markets in Sri Lanka closed due to the coronavirus, the FX market has frozen up with no active quotes. The bond market did have moderate trading with yields in the far end of the curve grinding higher. The government plans to auction 30bn rupees of treasury bills on Wednesday as well as a bond auction of up to $220mn of Sri Lanka development bonds in the 7month, 1 year 4 months, 3 years, 4 years and 10 months tenors.

For the full story, click here.

Top Gainers & Losers – 31-Mar-20*

Go back to Latest bond Market News

Related Posts:

1, 2, 3, 4th Fed Hike!

June 14, 2017

Fed Survey Results Supportive of Funds Flow into Bonds

September 10, 2017