This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fed’s Mester Makes Case for 50bp Hike; Macro; Rating Changes; New Issues; Talking Heads; Gainers and Losers

February 17, 2023

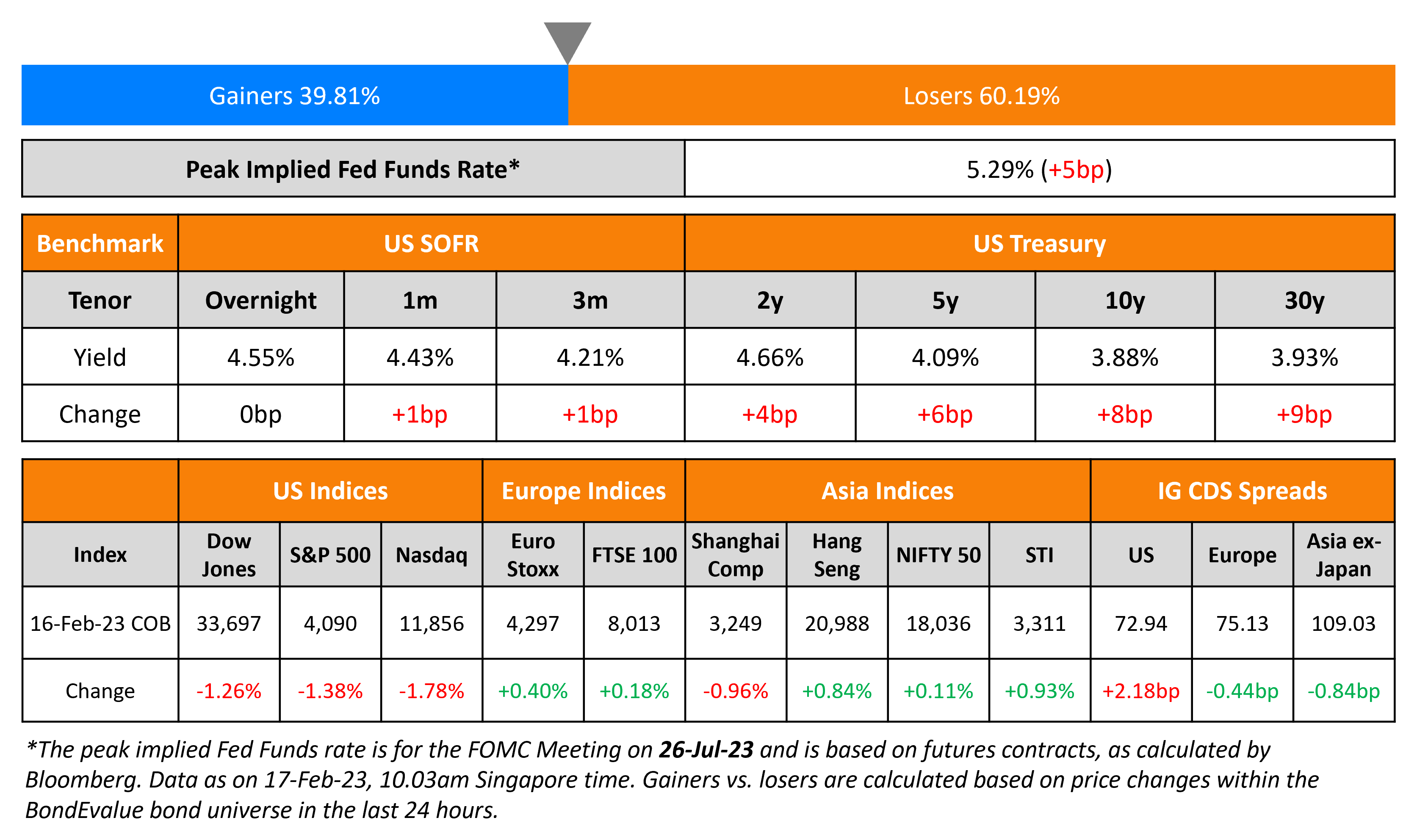

US Treasury yields jumped higher by over 5bp after Fed officials Loretta Mester and James Bullard came out with hawkish statements. In particular, Mester said that she “saw a compelling economic case for a 50bp increase” based on the incoming data. The peak Fed funds rate also jumped by 5bp to 5.29% for the July 2023 meeting. With a 25bp hike in March being priced in, markets are now also pricing in a possibility of a 50bp hike next month. CME probabilities show that the chance a 50bp hike in March has risen to 18% from 9% yesterday. Besides, markets are expecting another 25bp hike in May with a 76% probability. Broadly, US 10Y and 30Y yields are now at levels seen in the beginning of the year, whereas the 2Y yield is ~24bp higher this year. US IG CDS spreads widened by 2.2bp while HY spreads were 14bp wider. Equity indices were fell with the S&P and Nasdaq down by 1.4% and 1.8% respectively.

European equity markets ended higher. The European main CDS spread tightened 0.4bp while crossover CDS spreads tightened 2.7bp. Asian equity markets have opened lower today. Asia ex-Japan CDS spreads were 0.8bp tighter.

New Bond Issues

BNP Paribas raised €1bn via a 6NC5 bond at a yield of 3.916%, 12bp inside initial guidance of MS+90bp area. The senior preferred bonds have expected ratings of Aa3/A+/AA-, and received orders over €1.3bn, a bid-to-cover ratio (Term of the Day, explained below) of 1.3x. The current coupon of 3.875% is fixed until the optional redemption date on 23 February 2028. If not called, the coupon resets to 3m Euribor+78bp quarterly. The new bonds are priced 20.4bp tighter to its existing 4.375% 2029s that yield 4.12%.

AT&T raised $1.75bn via a 3NC1 bond at a yield of 5.539%, 15bp inside initial guidance of T+135bp area. The senior unsecured bonds have expected ratings of Baa2/BBB/BBB+. Proceeds will be used to repay a portion of the outstanding $2.5bn Term Loan Agreement maturing on 16 February 2025. The new bonds are priced at a new issue premium of 27.9bp to its existing 7.125% 2036s that yield 5.26%.

New Bonds Pipeline

-

REC hires for $ Long 5Y Green bond

Rating Changes

- Moody’s upgrades Coty’s CFR to Ba3; outlook stable

- Fitch Downgrades China Grand Auto to ‘CCC+’

Term of the Day

Bid-to-Cover Ratio

Bid-to-cover is a ratio of the number of bids or orders received for a particular security issuance vs. the amount issued. The bid-to-cover ratio indicates the demand for an issuance – higher the ratio, higher the demand and lower the ratio, lower the demand.

Talking Heads

On Fed officials saying more rate hikes key to reducing inflation – Fed’s Loretta Mester

“The incoming data have not changed my view that we will need to bring the fed funds rate above 5% and hold it there for some time… I saw a compelling economic case for a 50bp increase… I was an advocate for a 50bp point hike and I argued that we should get to the level of rates the committee viewed as sufficiently restrictive as soon as we could.”

On Predicting Extended Period of Elevated Rates – Blackstone’s Jonathan Gray

“It feels to me more like what we experienced in the early-2000 period where we had technology stocks that had run up too much, we had a Fed-induced slowdown that ended up being shallow and we then came out of it”

On Urging More Hikes to Ensure Disinflation Continues – Fed’s Bullard

“Continued policy rate increases can help lock in a disinflationary trend during 2023, even with ongoing growth and strong labor markets, by keeping inflation expectations low… In part due to front-loaded Fed policy during 2022, market-based measures of inflation expectations are now relatively low”

Top Gainers & Losers – 17-February-23*

Go back to Latest bond Market News

Related Posts: