This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fed Speakers Hint at Rate Pause in June; Macro; Rating Changes; New Issues; Talking Heads

June 1, 2023

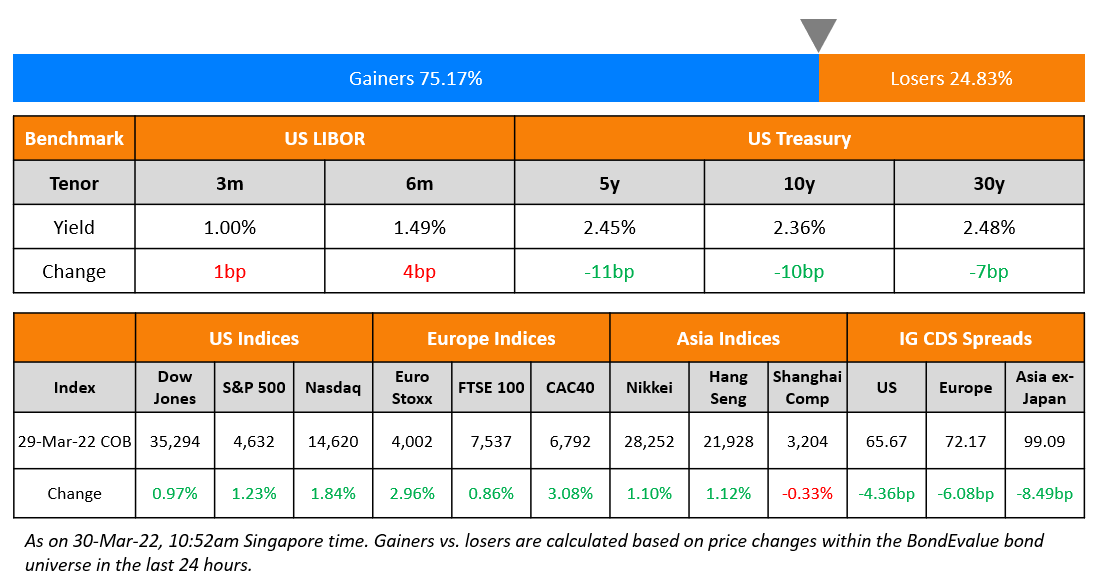

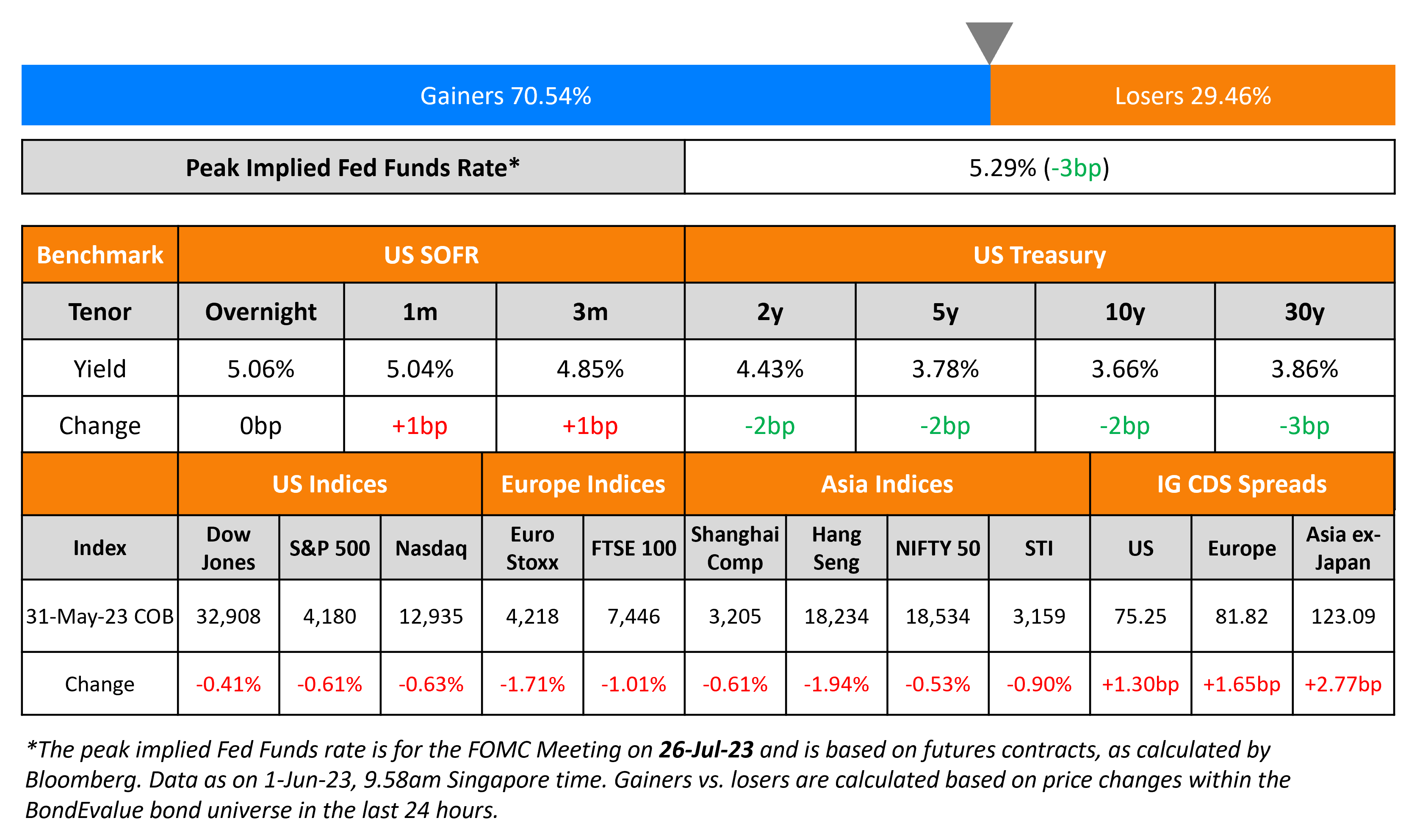

US Treasury yields were marginally lower by 2-3bp across the curve. Fed Governor and Vice-Chair Philip Jefferson hinted that the Fed may skip a rate hike at the June meeting and his remarks were also echoed by Philadelphia Fed President Patrick Harker (scroll below to the Talking Heads). This led to a big shift in CME probabilities for a Fed rate hike – markets are now pricing in a 60% chance of a status quo in June vs. a 60% probability of a 25bp hike in June yesterday. The peak Fed Funds Rate fell 3bp to 5.29% for July. Separately, the House passed the debt-limit legislation, which will now be sent to the Senate where the Democrats have a narrow majority, before President Joe Biden can sign it into law. Equity indices were slightly lower with the S&P and Nasdaq down by 0.6% each. US IG and HY CDS spreads widened 1.3bp and 7.1bp respectively.

European equity indices closed lower too. European main CDS spreads widened 1.7bp and Crossover spreads were 6.6bp wider. Asia ex-Japan CDS spreads saw a 2.8bp widening and Asian equity markets have opened marginally higher this morning.

Exclusive Event for BondEvalue Subscribers in Dubai | 19 June

New Bond Issues

Hong Kong raised $2.25bn and €1.5bn via a five-tranche green deal. The details of the issuance can be found in the table below:

.png)

Orders for the USD notes touched $21bn, while orders for the EUR notes hit €5.5bn. For its USD-denominated tranches, its 4% 2028s were priced at a new issue premium of 3.6bp compared to its existing green 4.5% 2028s that yield 4.06%, while its 4% 2033s were priced at a similar new issue premium of 4.1bp to its existing green 4.625% 2033s that yield 4%. The bonds have expected ratings of AA+ / AA- (S&P / Fitch). Proceeds will be used to finance/refinance projects that fall under one or more of the “Eligible Categories” under the Issuer’s Green Bond Framework, with the aims of providing environmental benefits and supporting the sustainable development of Hong Kong. It also raised 3 other green tranches in renminbi.

New Bonds Pipeline

- BGK hires for $ 10Y bond

- GS Caltex hires for bond

Rating Changes

- Fitch Downgrades Wanda Commercial to ‘BB-‘, Wanda HK to ‘B+’; Maintains Rating Watch Negative

- Moody’s downgrades Casino’s CFR to Caa3; outlook remains negative

Term of the Day

Tender Offer

A tender offer is an offer made by an issuer to bondholders to buyback their bonds. In return, the bondholders could get either cash or new bonds of equivalent value at a specified price. The issuer does this to retire some of its old debt and can use retained earnings to fund the purchases without affecting the liquidity position of the company. Tender offers have a deadline date before which holders must tender their bonds back.

Talking Heads

On a Fed Rate Hike “Skip” in June

Philip Jefferson, Fed Governor and vice chair nominee

“Skipping a rate hike at a coming meeting would allow the (Federal Open Market) Committee to see more data before making decisions about the extent of additional policy firming…a decision to hold our policy rate constant at a coming meeting should not be interpreted to mean that we have reached the peak rate for this cycle.”

Krishna Guha, Evercore ISI vice chairman

“We are as certain as we can be that this message would have been agreed with chair (Jerome) Powell beforehand and represents the collective Fed leadership view.”

Patrick Harker, Philadelphia Fed president

“I am in the camp increasingly coming into this meeting thinking that we really should skip, though data due on Friday about the U.S. job market may change my mind.”

Loretta Mester, Cleveland Fed president

“I don’t really see a compelling reason to pause.”

On European Banks Should Be Prudent on Payouts – ECB Vice-President De Guindos

“Given the uncertainty produced by the events in the US and Switzerland, banks have to be prudent… Capital is key and liquidity is becoming more and more relevant… Increasing interest rates is good for European banks, but we cannot be complacent. We cannot focus only on the short-term impact of the increasing interest rates”

On Expected US Debt Default Rates – Deutsche Bank

Forecasts point to peak default rates reaching 9% for US high-yield debt, 11.3% for US loans, 4.4% for European high-yield bonds and 7.3% for European loans. The 11.3% estimate for a US loan peak default rate would be a near all-time high, compared to a peak of 12% during the 2007-2008 GFC. Default risks for European firms appeared lower than U.S. peers given a higher percentage of better-rated bonds as well as greater European fiscal support and lower amounts of debt in high-growth sectors.

On Global Investment and Macroeconomic Outlook for H2 2023 – Lombard Odier

Yankai Shao, Lombard Odier head of investments solutions, Asia

“Bonds are rather reliable when the Fed ends its rate hikes…The future for equities is still more uncertain than the fixed income universe… With the reopening of China, there should be a boost for emerging market equities to help them to outperform”

Homin Lee, Lombard Odier senior macro strategist

“ECB is expected to do one rate hike in June, due to the strong inflation data seen recently, and then they will stop, keeping rates high for the next three to four quarters. Other central banks will do the same. Latin America will probably cut them earlier than others… looking at a less disruptive environment… (China) seems to be slowing down… Credit growth has been stalling recently and ideally they should give another credit push so that households can take advantage of the attractive borrowing rates”

Top Gainers & Losers – 01-June-23*

Go back to Latest bond Market News

Related Posts:-1.png)