This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

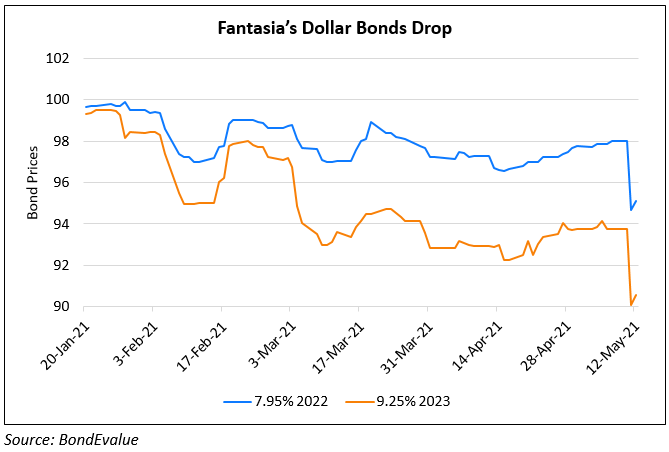

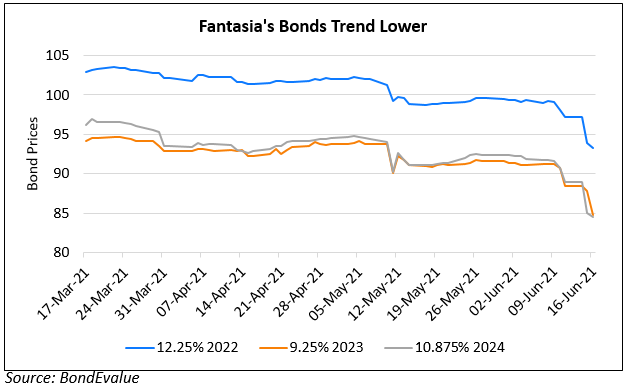

Fantasia’s Dollar Bonds Weaken

June 16, 2021

Another Chinese developer Fantasia saw its dollar bonds fall by over 2.5% on Tuesday and continue to move lower this morning. While the reason for the fall is not clear, Bloomberg Intelligence says that the fall may be triggered by weakness in Evergrande. Fantasia bought $10mn of bonds on Tuesday and Bloomberg Intelligence says that they have bought $41.6mn in the secondary market since May. They added that a stronger action like a tender offer for one of the bonds, say the $300mn 15% bonds due December 2021 could halt the slide. Fantasia said it “maintains good liquidity after purchasing the notes” and that it may make further buybacks depending on market conditions.

Go back to Latest bond Market News

Related Posts: