This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fantasia’s Dollar Bonds Rebound after New Issues and Tender Offer

June 18, 2021

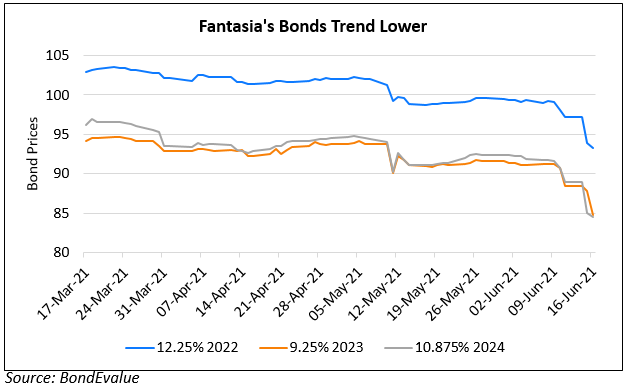

Fantasia Group’s dollar bonds rebounded after the company priced a new $200mn 3Y Reg S bond at 14.5% and launched a tender offer for its $400mn 7.375% 2021s. Fantasia’s bonds fell over 3% earlier this week with Bloomberg Intelligence citing the weakness in Evergrande spilling over to the company. For the tender offer for its 7.375% 2021s, Fantasia is offering $1,000 plus accrued and unpaid interest per $1,000 in principal. The deadline is June 28. Fantasia said the tender offer is part of its policy to actively manage its balance sheet liabilities and optimize its debt structure. Fantasia’s 7.375% 2021s trade at 99.875, slightly below the buyback price at 100.

Go back to Latest bond Market News

Related Posts:

Fantasia Launches Exchange Offer

May 20, 2021

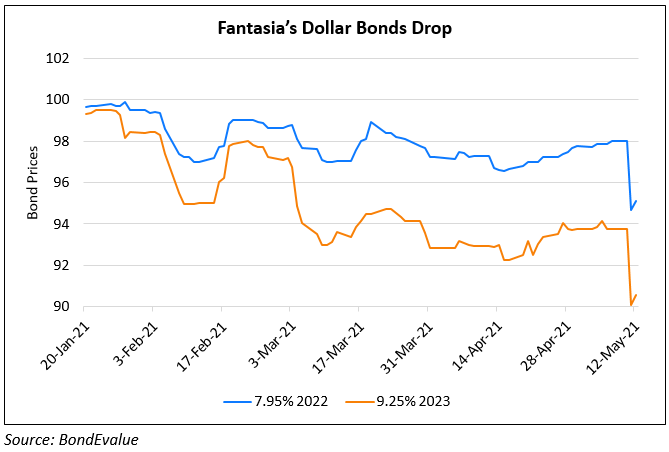

Fantasia’s Dollar Bonds Weaken

June 16, 2021