This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fantasia’s 2021s Crash on October Bond Default; Downgraded to CCC- from B by Fitch

October 5, 2021

Fantasia defaulted on its $205.656mn 7.375% bond due October 4. The bond did not have a grace period. Fantasia said it will assess “the potential impact on the financial condition and cash position of the group under the circumstances” adding that it will continue to “closely monitor the development of this matter” regarding the dollar bond. Lucror Analytics said, “In our view, this is an issue of willingness to pay instead of ability to pay” given that Fantasia claimed to have sufficient offshore cash to meet its October maturity. Besides, Fantasia’s property management unit Colour Life Services Group also failed to repay a short-term $108mn equivalent HKD loan to Country Garden.

Fantasia was downgraded by Fitch to CCC- from B on repayment risk and weak transparency. While Fantasia had $200mn of cash in offshore accounts at end-August 2021, which was sufficient to cover the USD bonds maturing in October, the developer confirmed to Fitch that $102mn of it was used to repay a previously undisclosed private bond on 28 September, 2021. Fantasia told Fitch for the first time about the existence of $150mn of private bonds guaranteed by the company that were not in its financial statements. Despite the management saying that no other offshore off-balance sheet borrowings exist beyond that bond, the existence of undisclosed liabilities affects its calculations on leverage, liquidity etc. Fantasia has $1.9bn in offshore bonds and RMB 6.4bn ($1bn) of onshore bonds maturing or turning puttable by end-2022 and despite cash of RMB 24bn ($3.7bn) uncertainty exists about Fantasia’s ability to access to such cash to repay these bonds. Besides, execution risks regarding asset disposals remain.

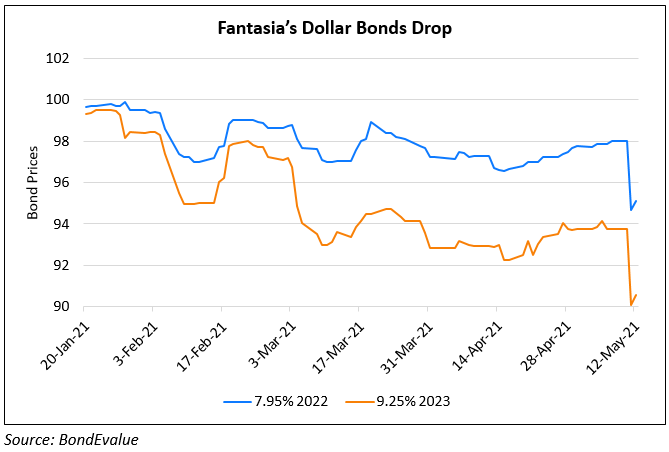

Fantasia’s 7.375% bond due October 4 was trading at 20 cents on the dollar as per Guotai Securities’ last quote from this morning, down from 98.5 yesterday. Its 15% bonds due December 2021 and 6.95% bonds due December 2021 plunged 45% to 37.5. Fantasia’s remaining dollar bonds are now over 5 points lower trading just over 25 cents on the dollar.

For the full story, click here

Go back to Latest bond Market News

Related Posts: