This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fantasia Outlook Down to Negative by Fitch

July 8, 2021

Fitch has revised Fantasia Group’s outlook to negative while affirming its rating at B+. The change in outlook was on account of Fantasia’s increased leverage (net debt/adjusted inventory), which reached their negative trigger of 50% and the decrease in its implied cash collection rate. They added that while Fantasia’s liquidity of CNY 22.5bn ($3.5bn) in cash is sufficient to cover its 2021 dollar bonds and short-term debt, given its reliance on dollar funding any weakness in credit markets could weigh on the company. Fantasia’s consolidated leverage after JVs rose to 50% by end-2020 vs. 45% in 2019, spending 40% of its sales for land acquisition. The 50% negative trigger established by Fitch is expected to continue this year, giving less leeway for a rating adjustment. Fantasia’s JV exposure/development inventories is high among B+ rated peers and Fitch notes that developers with lower JV exposure have higher flexibility to reduce consolidated leverage by decreasing stakes in projects. Fantasia’s low cash collection has also been low as contracted sales are high from off-balance sheet projects.

Overall, capital market debt was 76% of its total debt in 2020 (vs. 63% in 2019) with dollar bonds alone contributing 62% (vs. 48% in 2019). Fantasia is expected to rely more on bank loans as capital markets are a less stable source of financing with higher costs and is seen via its recent 14.5% coupon on its recently issued 3Y.

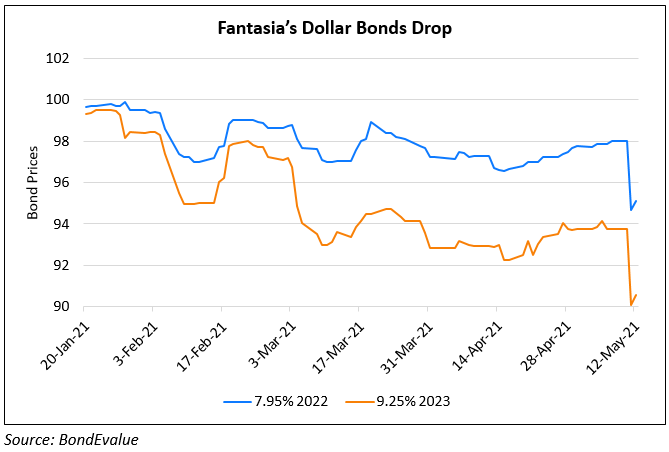

Fantasia’s dollar bonds were stable – its 9.25% 2023 were at 79.2 cents on the dollar.

Go back to Latest bond Market News

Related Posts: