This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Fantasia Downgraded to B by Fitch

September 20, 2021

Fantasia was downgraded by Fitch to B from B+, with a negative outlook due to lower than expected 1H2021 implied cash collection and uncertainty over the refinancing of a significant amount of dollar bond maturities through 2022 due to market volatility. A high contribution from JV projects are not consolidated into Fantasia’s financials and are less accessible leading to a lower cash collection. Fitch defines cash collection as revenues plus change in contract liabilities and it stands at a low 11% of contracted sales in H1. Besides, Fantasia’s JV investments and net amount due from JVs increased to RMB 10.5bn ($1.6bn) in 2020, from RMB 4.3bn ($670mn) in 2019. Leverage (net debt/adjusted inventory), remained at ~50% in 1H2021, high compared to Modern Land’s 40% as well as that of B+ peers, such as Hong Yang Group’s 43%, Hopson Development’s 45% and Redco’s 25%. Also, implied cash collection rate of 29% in 2020 and 11% in 1H2021 was lower than Modern Land’s 37%, Hopson’s 61% and Redco’s 51% in 2020.

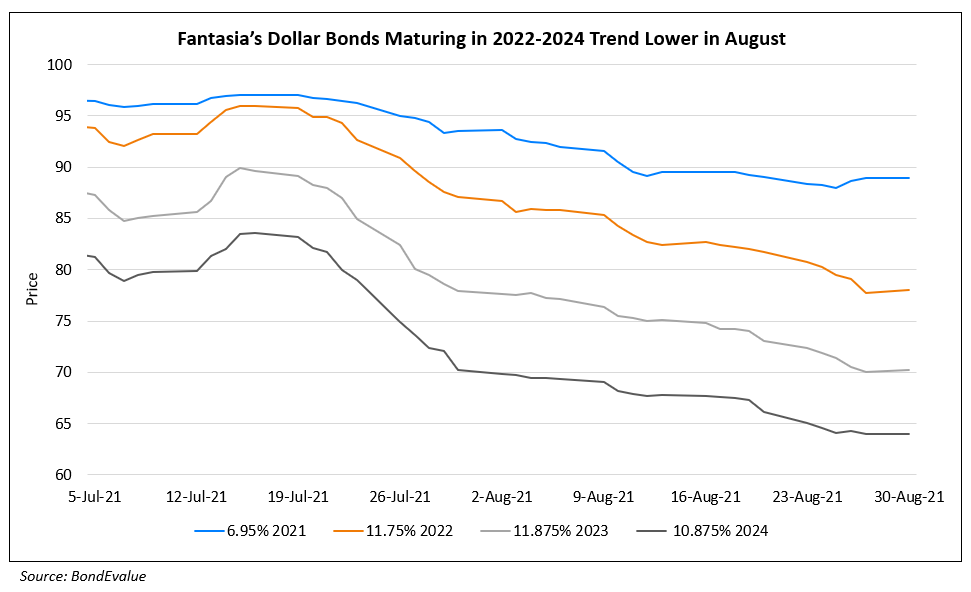

The current deterioration in Fantasia’s bonds makes it challenging for them to issue or extend capital-market debt. USD-denominated debt accounts for 53% of their total debt 1H2021. They have a large amount of debt maturities from now till end-2022, including $1.9bn of maturing dollar bonds and RMB 6.4bn ($990mn) of onshore bonds maturing or becoming puttable. While it has RMB 24bn ($3.7bn) in cash and plans to boost liquidity through asset sales, it is yet to repay near-term dollar maturities and is subject to execution risk. Fitch added that while overall land bank quality was satisfactory, some large projects are in less prime areas have a lower churn.

Fantasia’s leverage of ~50% was higher than Modern Land’s 40% as well as that of ‘B+’ peers, such as Hong Yang Group’s 43%, Hopson Development’s 45% and Redco’s 25%. Also, implied cash collection rate of 29% in 2020 and 11% in 1H2021 was lower than Modern Land’s 37%, Hopson’s 61% and Redco’s 51% in 2020.

Fantasia’s dollar bonds dropped again – its 15% bonds due December 2021 were down 11% or 9 points to 71.63 on Friday.

For the full story, click here

Go back to Latest bond Market News

Related Posts: