This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Evergrande’s Venice Project Taken over by Oaktree; Shimao Sells Shanghai Hotel for $708mn; Hopson Auditor Resigns

January 31, 2022

Evergrande’s prized asset in China, its Venice project in Jiangsu province has been seized by Oaktree Capital, a distressed debt specialist company. As per sources, Evergrande’s Venice project defaulted on a secured loan provided by Oaktree late last year after the latter loaned the developer $1bn for two projects. Due to the default the $158bn asset-manager Oaktree took control of the project’s equity, restart construction and begin selling its apartments. Besides, Oaktree also took control of Evergrande’s 2.2mn sqft. “Castle” project land in Hong Kong. Oaktree taking control of both projects means that Evergrande cannot sell them to raise cash as part of its restructuring. Evergrande has invested around $4.7bn in the Venice project since the beginning. Evergrande’s dollar bonds were trading at over 16 cents on the dollar.

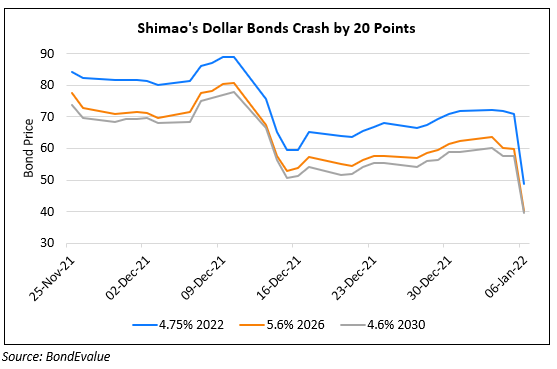

Shimao Group said it would sell a hotel in Shanghai to state-owned company Shanghai Land Group for RMB 4.5bn ($707.83mn). The deal is part of the Chinese government’s push to buy assets from cash-strapped private developers. The sale comes after Agile Group, another embattled Chinese property firm, sold stakes in several units worth ~RMB 2bn ($310mn) to state-owned companies China Overseas Land & Investment (CHIOLI) and China Conch Venture. Shimao’s dollar bonds were stable, trading at 40-50 cents on the dollar.

Developer Hopson Development Holdings said its auditor PwC resigned after receiving insufficient information to complete auditing procedures. The news increases concerns about the property sector ahead of the earnings season. The resignation of PwC adds to news last week where China Aoyuan said that its auditor Deloitte Touche Tohmatsu Ltd. resigned as the auditor was unable to reach a consensus on the audit fee for the consolidated financial statements. “PricewaterhouseCoopers (PwC)’s sudden resignation as the auditor of Hopson, a relatively strong China property developer, could kickstart the mass resignation of other auditors,” Bloomberg Intelligence analyst Andrew Chan said. Hopson is rated B-/B+ Hopson’s dollar bonds were flat with its 7% 2024s at 93 cents on the dollar.

Go back to Latest bond Market News

Related Posts: