This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Evergrande’s Bonds Take Another Beating; Spillover Seen in Fantasia, R&F

September 2, 2021

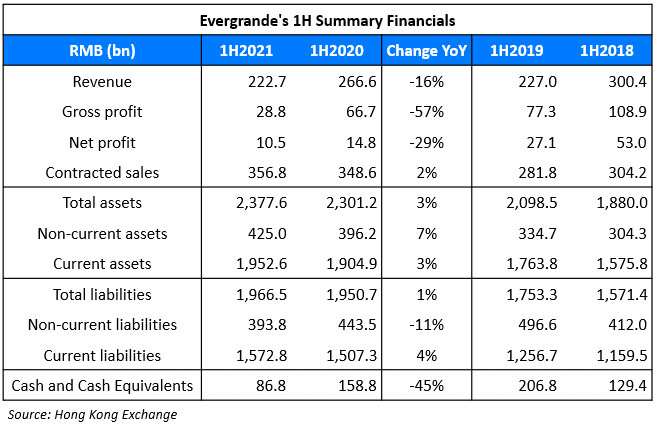

Wednesday saw another round of selling in Evergrande’s dollar bonds as they fell another 3 points to now trade in the 30s. The latest selloff was after the company released 1H earnings in which they warned of a possible default as its liabilities keep piling up while funding has dried up, given the series of negative news flow on the world’s most indebted developer. Evergrande Chairman Hui Ka-yan tried to calm investors and buyers of its properties by holding a public pledge-signing ceremony where it vouched to complete its property projects. CreditSights analysts said in a note, “A key factor for whether Evergrande avoids default is the developer not facing widespread construction suspensions as it negotiates with suppliers and contractors,” as per Bloomberg. The credit research house further added that they predict a bond restructuring as a more likely scenario as compared to liquidation, given precedents from Kaisa and CFLD and the poor recovery values associated with liquidations.

Stress around Evergrande spilled over to other real estate developers too as there was a rather strong selloff in dollar bonds of Fantasia and R&F Properties (Easy Tactic). Fantasia’s 10.875% bonds due 2024 fell 9 points to currently trade at 54.5 cents on the dollar while Easy Tactic’s 11.625% bonds due 2024 fell 3.5 points to 69.1 cents on the dollar. Kaisa’s bonds also traded weaker with its 11.65% bonds due 2026 falling 2 points to 91.4. Eddie Chia, portfolio manager at China Life Franklin in Hong Kong said, “In the face of the selloff, developers should be panicking. They have been waiting for a window to tap the market. With funding squeezed it will eat into their already tight margins.”

For the full story, click here

Go back to Latest bond Market News

Related Posts: