This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Evergrande Decides Against Special Dividend Plan

July 28, 2021

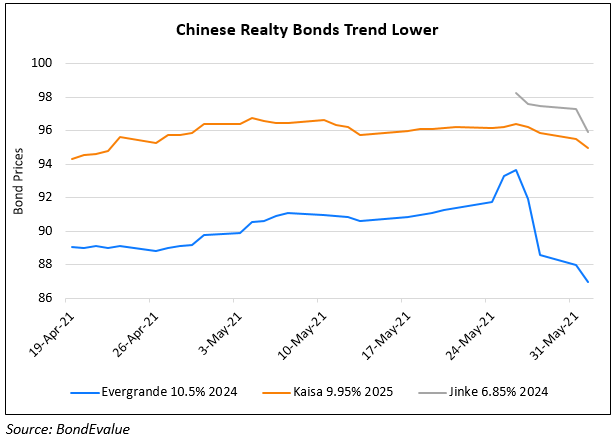

Evergrande announced that it will hold-off on paying a special dividend two weeks after they had called for a board meeting to discuss a special dividend plan. In making the decision, the company said that it considered the current market environment, the rights of shareholders and creditors, and the long-term development of businesses, according to a statement. Bloomberg reports that the decision confirmed analysts’ views that reckoned Evergrande may take one of the following three routes – cash payment, stock dividend or handing out shares in its higher-value listed subsidiaries. The announcement comes a day after S&P’s two-notch downgrade to B-. On a separate note, Bloomberg cites sources who said that Evergrande’s head Hui Ka Yan in a video conference earlier this month told investors to ignore the headlines, rumors, short-sellers and the noise behind the company.

However, investor concerns continue to grow as Evergrande’s stock closed 15% lower in Hong Kong and its bonds were not spared either with its 13% 2022s down 6 points to 51.2. Nomura credit analyst Iris Chen wrote in a note Tuesday, “Evergrande could find it difficult to get out of this vicious cycle as confidence in the company has collapsed across almost all stakeholders.” Jennifer James, a portfolio manager at Janus Henderson Investors commented, “It’s pretty clear that this situation has really accelerated. The Chinese government can act quickly if they choose to contain this. The systemic and societal risks are indeed high.”

Go back to Latest bond Market News

Related Posts: