This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

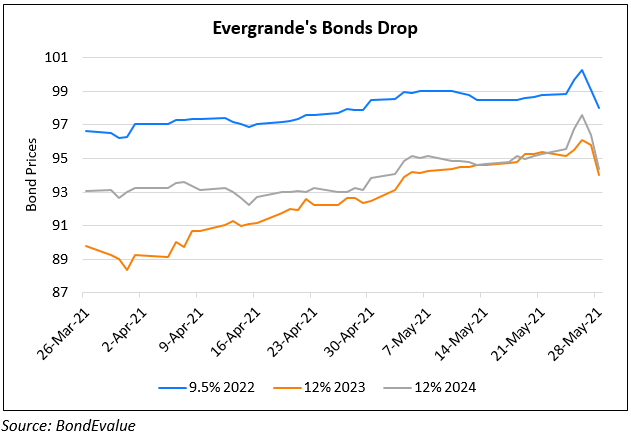

Evergrande Cuts Borrowings by 10% to $109 Billion

April 1, 2021

China Evergrande reported results yesterday with revenues up 6.2% YoY ending December 2020 to CNY 507.25bn ($77.3bn). Net profits came at CNY 31.40bn ($4.8bn) for the period, down 6.4% YoY and gross margins fell to 24%, its lowest since 2004. Contracted sales during amounted to CNY 723.25bn ($110bn), an increase of 20.3% as compared with 2019. Amongst the keenly watched aspects was Evergrande’s debt levels and reduction – total borrowings were at CNY 716.5bn ($109bn), a reduction of 10% YoY while net finance costs fell 90% to CNY 2.24bn ($340mn) partly on the back of ‘exchange gains from borrowings’. They proposed a final dividend of CNY 0.152/share ($0.02/share). CLSA analysts said, “We believe the strong sales momentum, together with its efforts to deleverage, bodes well for its earnings growth and balance-sheet improvements over the next three years”.

Evergrande’s dollar bonds were stable with its 11.5% 2023s up 0.2 to 94.5, yielding 15%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: