This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Evergrande and R&F The Only Major Developers in Breach of Three-Red-Lines

April 13, 2021

Bloomberg in a study of Chinese real estate developers’ three red-lines metrics saw that almost half of China’s 66 major property developers met all the requirements as of end-December 2020 . Of the three red lines, namely cash to short-term debt, net-debt to equity, and liabilities to assets ex-advanced proceeds, developers saw the biggest improvement in their cash to short-term debt ratio which shrank 64% in the last six months. According to Bloomberg, many firms struggled with their liabilities-to-assets ratio, with 30 of the 66 companies remaining non-compliant while the number of developers breaching the 100% net-debt to equity cap halved in the last six months. The study noted that Evergrande and R&F Properties are the only major developers that have breached all of the metrics. For example, Evergrande’s cash covers only 0.47x of their short-term debt and their net-debt to equity is at 158% while for R&F the ratios stood at 0.38x and 218% respectively. Even as companies try to improve metrics, analysts say some might be window dressing their finances – Nomura’s Chen says, “A material increase of minority interests can boost developers’ equity base…this can be an easier way to lower the net gearing ratio than actually decreasing the net debt.”

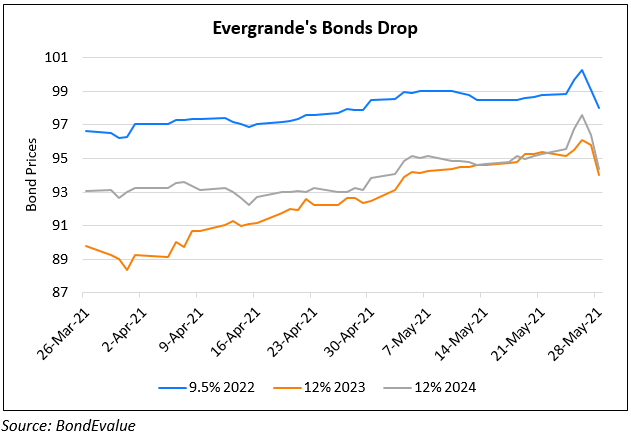

Evergrande’s bonds were slightly higher with its 4.25% 2023s up 1.3 to 97.5, yielding 5.7%. Easy Tactic’s bonds guaranteed by R&F were also marginally higher with its 9.125% 2022s up 0.1 to 100.5 yielding 8.7%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: