This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

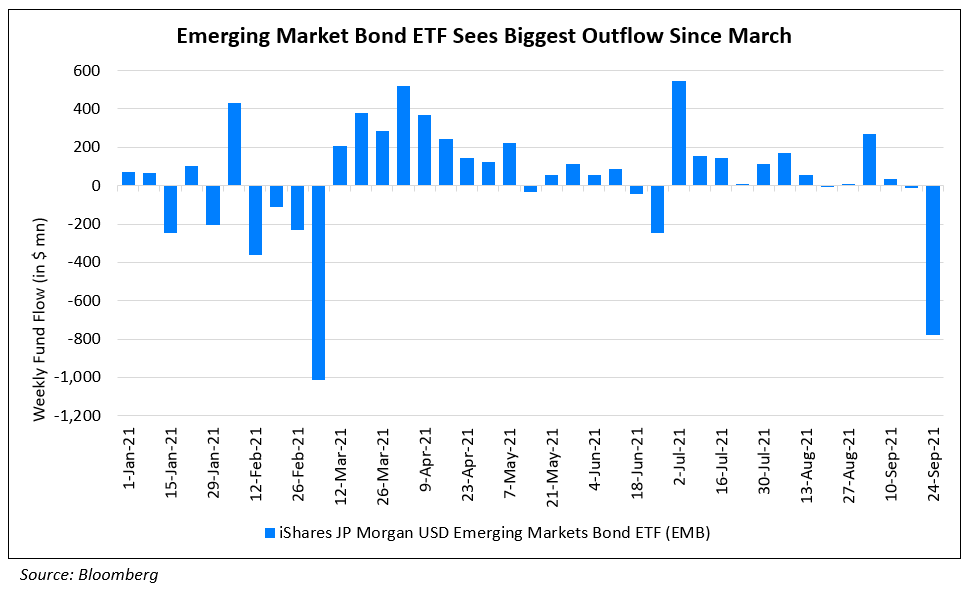

Emerging Markets Dollar Bond ETF Sees Outflows of $781mn Last Week

September 28, 2021

The iShares JP Morgan USD Emerging Market Bond ETF (EMB), which invests in USD denominated government bonds from EM countries, saw its biggest weekly outflows last week, $781mn for the week ended September 24, the largest since early March this year. Guido Chamorro, co-head of emerging-market hard-currency debt at Pictet Asset Management said, “The recovery in emerging market bonds that started in April 2021, I believe, is taking a healthy pause and small correction. I see it as a bit of indigestion with two big risk events that took place last week: U.S. Fed and Evergrande.” On an overall basis, EM bond funds saw outflows of $82.8mn while EM stock ETFs saw inflows of $256.3mn, making it a fifth week of net inflows into ETFs that invest in EM assets.

For the full story, click here

Go back to Latest bond Market News

Related Posts: