This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

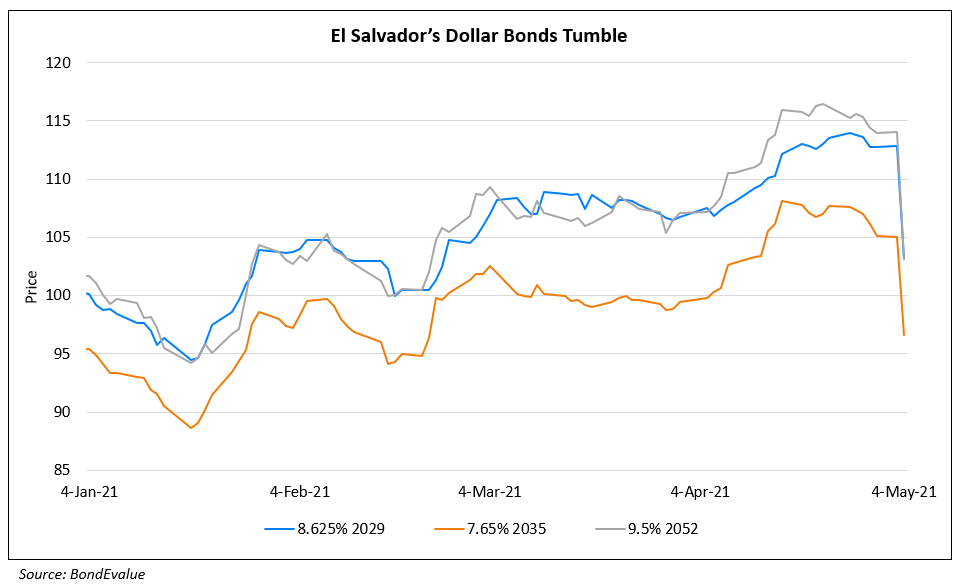

El Salvador’s Bonds Fall on Crypto Push

June 11, 2021

El Salvador adopted Bitcoin as a legal tender, causing concerns by the International Monetary Fund (IMF) over various risks and regulatory challenges. “Adoption of Bitcoin as legal tender raises a number of macroeconomic, financial and legal issues that require very careful analysis so we are following developments closely and will continue our consultation with authorities,” said IMF spokesman, Gerry Rice. The IMF team is scheduled to hold a virtual meeting with El Salvador discussing its Article IV review of the country and a potential credit program. The congress of El Salvador approved a law that requires businesses to recognize and accept Bitcoin as a currency of exchange for goods and services.

President Nayib Bukele stated that the digital currency will help counter El Salvador’s low banking penetration and reduce the country’s cost of sending remittances. El Salvador’s bonds fell, making them the worst performers within emerging markets this week. “The plans for Bitcoin under an increasingly autocratic regime will likely only compound concerns about corruption, money laundering and the independence of regulatory agencies,” wrote Siobhan Morden, head of Latin America Fixed Income Strategy at Amherst Pierpont.

El Salvador’s dollar bonds were down with its 6.375% 2027s down 3.23 points to 93.26, yielding 7.89% and its 9.5% 2052s down 5.29 to 102.34, yielding 9.27%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: