This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Egypt’s Potential Power Plant Deal May Fetch $2bn

June 9, 2023

Egypt may enter a deal with Actis and Edra Power Holdings over the sale of one of its major power plants for a price tag of about $2bn. If the deal goes through, this will help boost their troubled economy amid its efforts to bring fresh hard currency and boost privatization efforts. Interest over this sale by the two companies was previously expressed in 2019 but did not materialize. However, a recent revival of interest saw both companies intending to acquire full ownership and operate the facility. The plant is one of three co-built by Siemens AG and inaugurated by the President in 2018 as part of a series of ambitious megaprojects. A cost of roughly $6.4bn was incurred to build the three power plants. The new buyer(s) would assume the responsibility to pay financial dues, thus reducing the state’s debt burden.

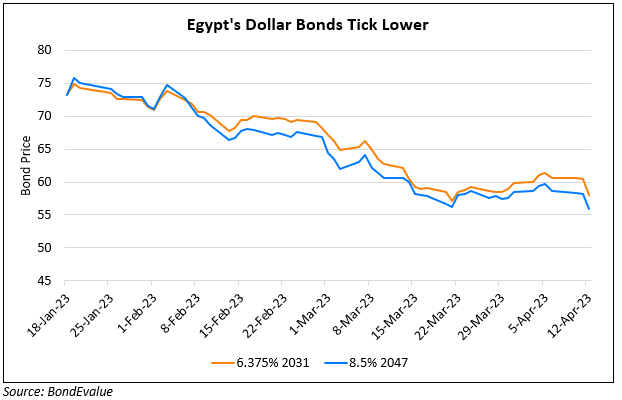

Egypt’s 5.875% 2031s have rallied 9.9% since the start of the month and are currently trading at 58.8 cents on the dollar, yielding 15.1%.

For more details, click here

Go back to Latest bond Market News

Related Posts: