This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

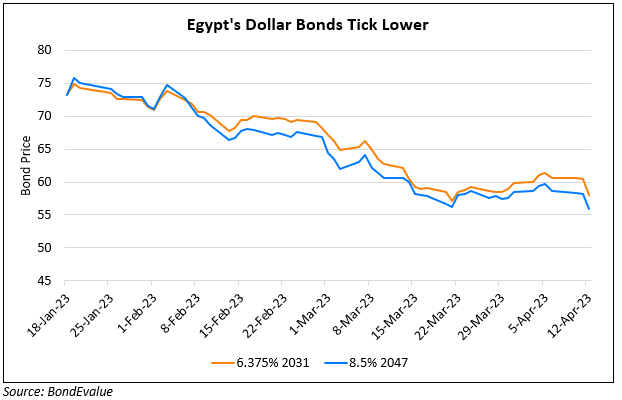

Egypt’s Dollar Bonds Trade Lower by 3-4% on Drop in Foreign Assets

August 3, 2023

Egypt’s dollar bonds moved 3-4% lower after net foreign assets held in its commercial banks reached a record deficit of $17.1bn in June (from a $14.5bn deficit in May). This decrease was driven by a lack of inflows and its efforts to stabilize its domestic currency. The country has been grappling with the worst foreign-currency shortage it had experienced in years as it continues to draw on its reserves to stabilize its local currency that was adversely hit by the Russia-Ukraine war. Egyptian authorities are currently trying to boost their liquidity as they are facing pressures to sell-off local currency holdings to clear a backlog of foreign-currency requests from importers and other companies, fueling further depreciation pressures. The currency is already down 20% YTD. Egypt is still waiting for a review of a programme they have with the IMF. The multilateral lender has said earlier, that they will only review the programme once Egypt enacts more of the wide-ranging reforms it had pledged.

Egypt’s 7.5% 2027s have fallen 5% since the start of the week and are currently trading at 75.7 cents on the dollar, yielding 17%.

For more information, click here

Go back to Latest bond Market News

Related Posts:

Egypt Downgraded to B3 by Moody’s

February 8, 2023

Egypt-World Bank Agree On $7bn 5-Year Partnership

March 24, 2023