This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Egypt’s Dollar Bonds Fall By 3%

March 1, 2023

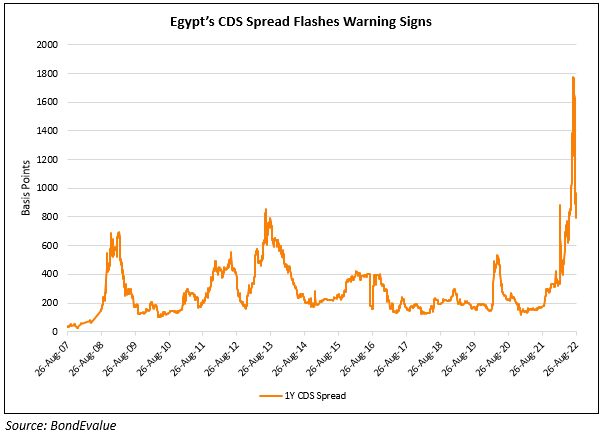

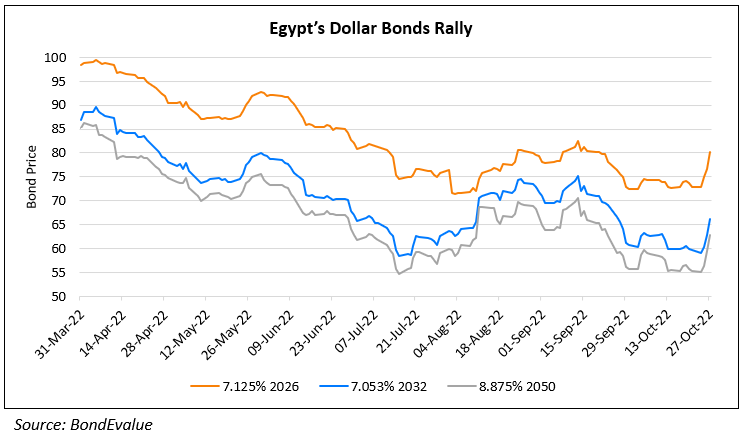

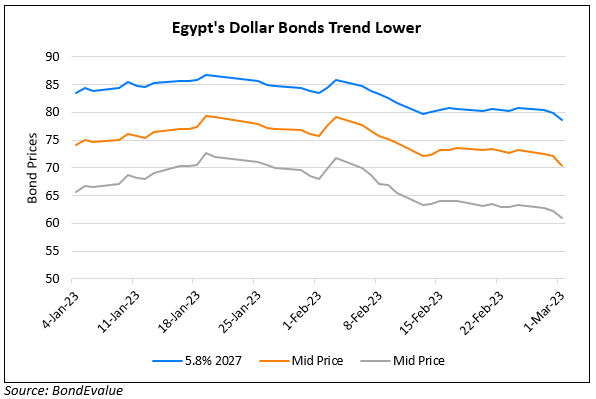

Egypt’s dollar bonds fell by over 3% across the curve. Bloomberg reports that the cost of insuring Egypt’s debt against default using CDS rose from 879bp to 1,052bp, the highest this year. Egypt’s dollar bonds had been steadily declining over the course of February ever since it was downgraded to B3 from B2 by Moody’s. Due to a $3bn loan package secured from the IMF and pledges of financial support from Gulf Arab allies, Egypt’s bonds had rallied from November until January. However, with neither of the above offering a quick solution anytime soon, Egypt has faced pressures. Kaan Nazli, senior economist and money manager at Neuberger Berman Asset Management said, “Egyptian bonds are a popular overweight for emerging- market sovereign credit investors and tend to trade in line with risk sentiment”. Gulf allies including Saudi Arabia and Qatar have earmarked more than $10bn for the country. As per Bloomberg, Gulf funding is considered “critical” for Egypt to bridge a funding gap of ~$17bn. Over the course of the last one year, Saudi Arabia, Qatar and UAE have deposited $13bn with the Egyptian central bank.

Go back to Latest bond Market News

Related Posts: