This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Egypt’s Dollar Bonds Drop Over 4%; Seeks Up to $6bn From Sale of State Firms by June 2023

September 26, 2022

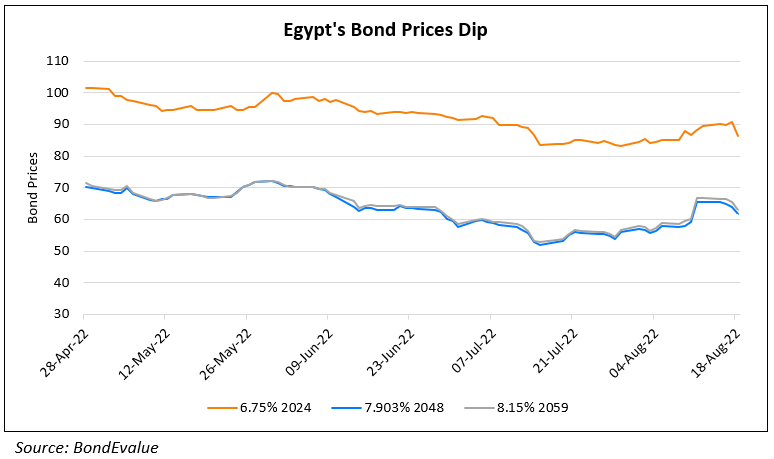

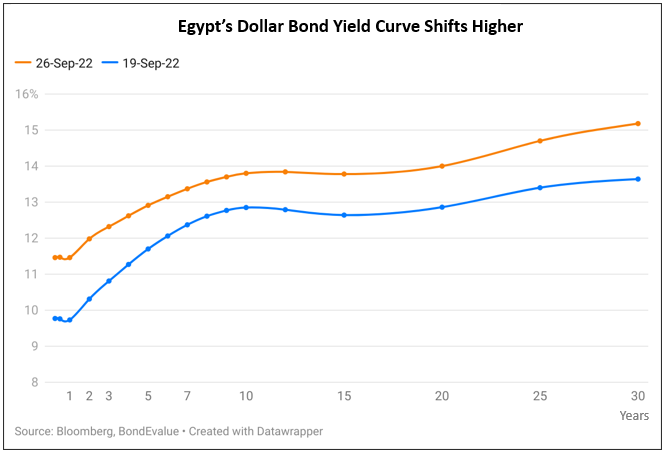

Egypt’s dollar bonds have been trending lower over the past week with some bonds down ~4% on Friday. The move across the curve comes as the North-African economy is currently facing difficult times with inflation at ~15%, having been impacted by the Russia-Ukraine war. As seen in the chart below, dollar bond yields have risen by 100-150bp across the curve, with larger moves seen in the short- and long-end.

In other news, Egypt plans to raise up to $6bn before June 2023 by selling stakes in state-owned businesses. Egypt’s planning minister Hala Elsaid said that this may include share offerings to the public or block sales to strategic investors. While she did not name the companies, she said that the program will be supported by its sovereign wealth fund. Egypt is trying to attract higher FDI flows and is negotiating a new loan with the IMF to shore up its finances.

For the full story, click here

Go back to Latest bond Market News

Related Posts: