This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

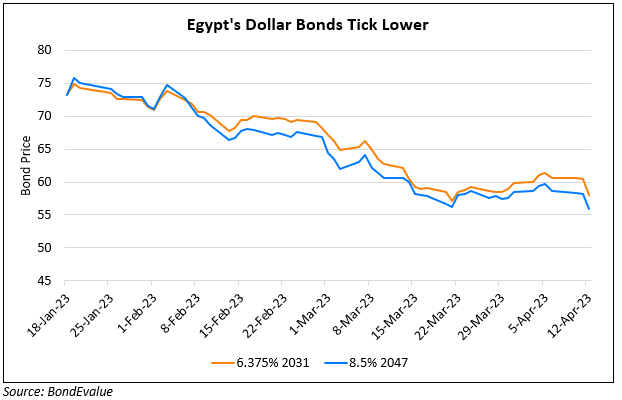

Egypt’s Dollar Bonds Dip After Inflation Touches 33%, Highest Since 2017

April 12, 2023

Egypt’s dollar bonds fell by over 2 points across the curve after the nation’s inflation came at 32.7% in March, its the fastest pace since 2017. While the pick-up in inflation was in part due to base effects, the recent drop in Egyptian pound is also said to be showing its impact on the economy. As per Cairo-based Naeem Brokerage, if Egypt allows the currency to depreciate by another 10% after Ramadan, annual inflation may reach 33-34% by end-June. The central bank only recently hiked policy rates by 200bp to 18.25% in a bid clamp down on inflation. Ever since the beginning of the Russia-Ukraine war, Egypt has devalued the pound three times.

Egypt’s bonds have been trending lower since February when it was downgraded to B3 from B2 by Moody’s citing “reduced external buffers and shock absorption capacity”.

For more details, click here

Go back to Latest bond Market News

Related Posts: