This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ECB, BOE Hike Rates by 50bp; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

February 3, 2023

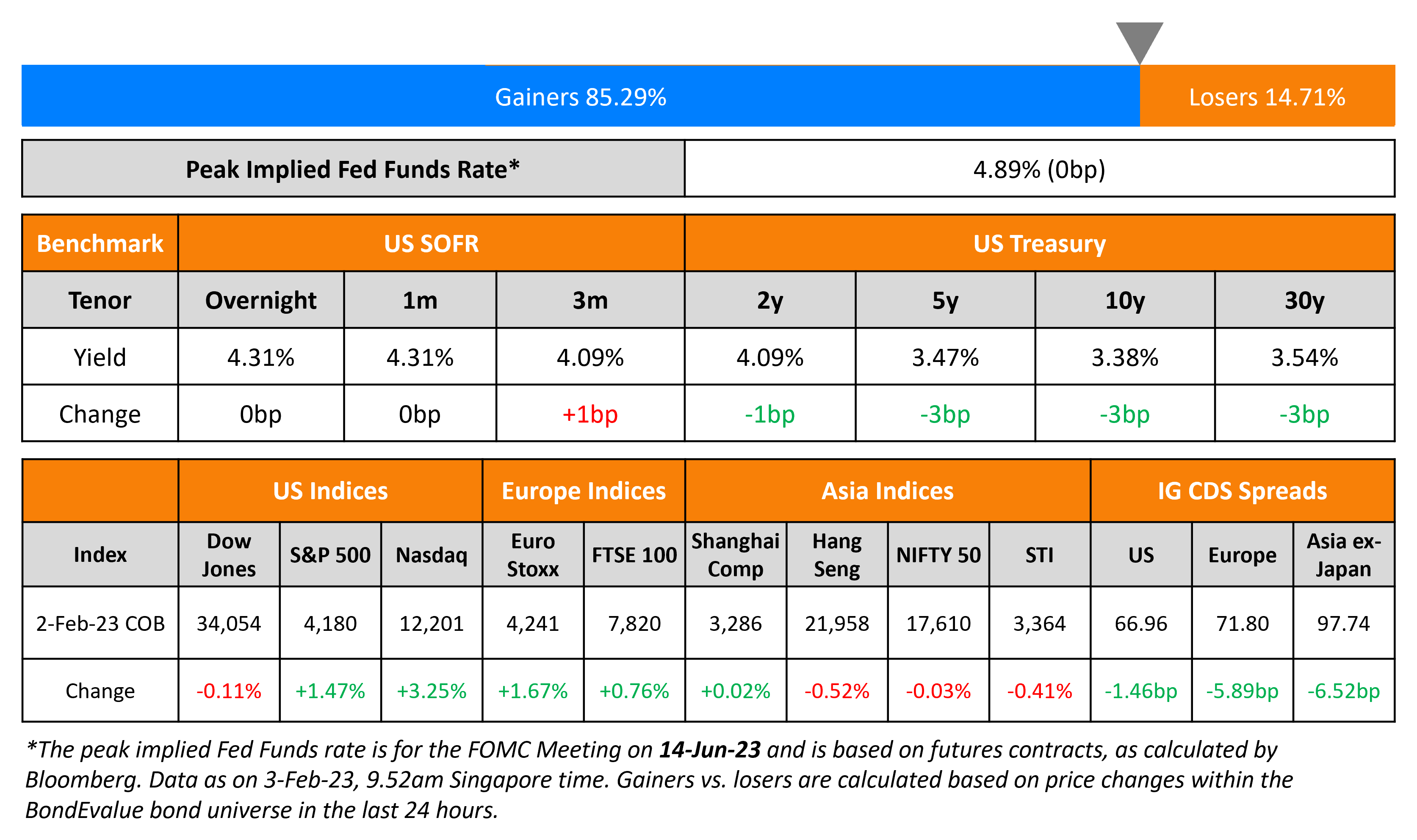

Bond markets continued its rally with benchmark yields down ~3bp across the curve. The peak Fed funds rate was flat at 4.89% for the June 2023 meeting. Currently the probability of a 25bp hike in the FOMC March meeting stands at 89%. US IG CDS spreads tightened by 1.5bp while HY spreads were 7.8bp tighter. Equity indices were also higher with the S&P and Nasdaq were up 1.5% and 3.3% respectively on Thursday, with tech majors coming out with their earnings reports.

The ECB hiked its policy rates by 50bp with its deposit facility rate (Term of the Day, explained below) now at 2.5%. ECB President Lagarde said that she intends to raise rates by another 50bp at the next meeting. Further action will be evaluated after looking at data. Similarly, the BOE also hiked its policy rate by 50bp to 4% adding that more rate hikes may be needed. European equity markets also ended higher. The European main and crossover CDS spreads tightened by 1.3bp and 26.9bp respectively. Asian equity markets have however opened with a negative bias today. Asia ex-Japan CDS spreads were 6.5bp tighter.

New Bond Issues

Oracle raised $5.25bn via a four-tranche deal. It raised

-

$750mn via a 5Y bond at a yield of 4.538%, 40bp inside initial guidance of T+145bp area. The new bonds are priced 0.8bp wider to its existing 3.25% 2027s that yield 4.53%.

- $750mn via a 7Y bond at a yield of 4.699%, 40bp inside initial guidance of T+165bp area. The new bonds are priced 11.1bp tighter to its existing 2.875% 2031s that yield 4.81%.

- $1.5bn via a 10Y bond at a yield of 4.909%, 35bp inside initial guidance of T+185bp area. The new bonds are priced 4.1bp tighter to its existing 6.25% 2032s that yield 4.95%.

-

$2.25bn via a 30Y bond at a yield of 5.585%, 40bp inside initial guidance of T+240bp area. The new bonds are priced 14.5bp wider to its existing 4.375% 2055s that yield 5.44%.

The senior unsecured bonds have expected ratings of Baa2/BBB/BBB. Proceeds will be used to prepay remaining borrowings of $3.1bn under the Bridge Facility in full, and repay outstanding senior bonds due February 2023. Any remaining amount will be used to repay all or a portion of Oracle’s outstanding commercial paper notes.

New Bonds Pipeline

- Khazanah Nasional Bhd hires for $ bond

Rating Changes

Term of the Day

Deposit Facility Rate

The deposit facility rate (DFR) is one among the three key interest rates set by the ECB. This rate defines the interest rate that banks receive on the surplus liquidity that they deposit overnight in an account with a national central bank. The Eurosystem has several national central banks with ECB being the prime central bank that works with the other national central banks of all EU countries.

There are two other key interest rates that the ECB governs – the rate on main refinancing operations (MROs) and the rate on the marginal lending facility (MLF). The MRO rate refers to the cost of borrowing for banks from the central bank for a period of one week. The MLF rate refers to the overnight rate that banks can borrow at from the central bank.

Following yesterday’s rate hike by 50bps, the current DFR is at 2.5%, with the MRO rate at 3% and MLF rate at 3.25%.

Talking Heads

On ECB ‘not done’ with interest rates rises to curb inflation – ECB President, Christine Lagarde

ECB still has “ground to cover”… “We know that we have ground to cover, we know that we are not done… The ECB’s determination to return inflation to its two-percent target “should not be doubted”

On Adani’s Debt Pile ‘Scared Us Away’ From Share Sale – EM Investor, Mark Mobius

“We were not interested in Adani companies because they did not meet our investment criteria, particularly as regards to debt”… Hindenburg report “is an Adani problem… India is still going to still go from strength to strength. It’s an incredible country with incredible prospects. I think it’s just one of the typical scandals you get in capital markets and it’ll pass”

On Fed’s Powell saying no rate cuts this year, but markets hearing it differently

Fed Chair, Jerome Powell

“It’s going to take some time… given our outlook, I just I don’t see us cutting rates this year… It is our judgment that we’re not yet in a sufficiently restrictive policy stance, which is why we say that we expect ongoing hikes will be appropriate”

Tim Duy, Chief US economist at SGH Macro Advisors

“The actual outcome is data dependent, and we won’t have the data to confirm or deny…until we are deeper into the first half of the year”

Dreyfus and Mellon Chief Economist Vincent Reinhart

“Investors are inviting him to be Arthur Burns, and he doesn’t want to accept that invitation”

Gregory Daco, Chief economist at EY Parthenon

“This loosening of financial conditions is undoubtedly not what the Fed was aiming for, and we expect a cacophony of Fed speeches in the coming weeks will aim to reorient the Fed’s message”

Top Gainers & Losers – 03-February-23*

Go back to Latest bond Market News

Related Posts: