This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Lenovo, Korea Hydro Launch $ Bonds; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

July 20, 2022

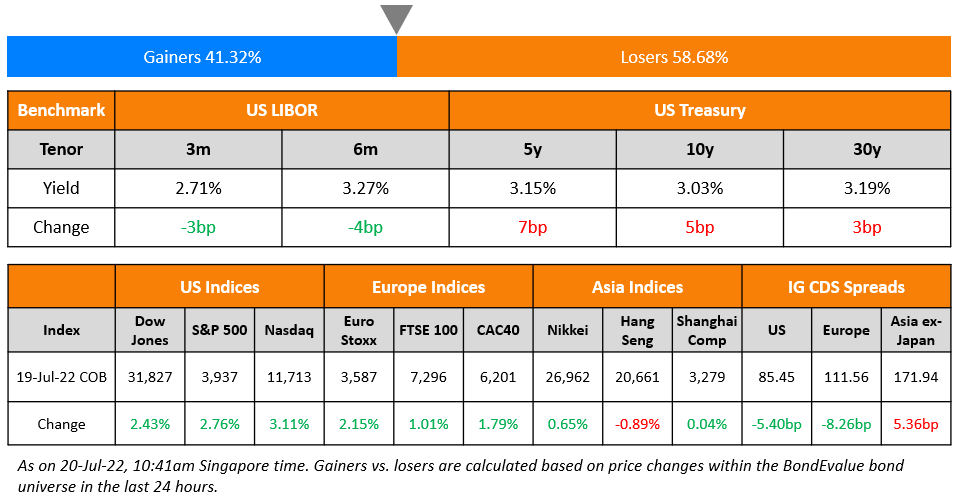

US equity markets ended with strong gains on Tuesday with the S&P and Nasdaq up 2.8% and 3.1% respectively as risk aversion receded. Sectoral gains were led by Communication Services and Industrials up 3.6% each. US 10Y Treasury yields were 5bp up at 3.03%. European markets were also higher with the DAX, CAC and FTSE up 2.7%, 1.8% and 1% respectively. Brazil’s Bovespa inched higher by 1.4%. In the Middle East, UAE’s ADX and Saudi TASI were up 0.5% and 1.8%. Following the US, Asian markets have also opened stronger – Shanghai, HSI, Nikkei and STI were up 0.7%, 1.9%, 2.4% and 1.3% respectively. CDS markets also saw relief from the improvement in risk sentiment. US IG CDS spreads narrowed 5.4bp and US HY spreads were tighter by 31.5bp. EU Main CDS spreads were 8.2bp tighter and Crossover spreads were tighter by 39.5bp. Asia ex-Japan IG CDS spreads widened 5.4bp.

New Bond Issues

- Lenovo $ 5.5Y Conventional/10Y Green at T+290/370bp areas

- Korea Hydro & Nuclear Power $ 5Y at T+150bp area

Bank of America raised a solid $10bn via a 3-tranche deal. It raised

- $2bn via a 4NC3 bond at a yield of 4.827%, 20bp inside initial guidance of T+180bp area. The new bonds are priced at a new issue premium of 16.7bp to its existing 3.384% 2026s callable in 2025, that yield 4.66%.

- $3bn via a 6NC5 bond at a yield of 4.948%, 25bp inside initial guidance of T+205bp area. The new bonds are priced at a new issue premium 17.8bp to its existing 4.376% 2028s callable in 2027 that yield 4.77%.

- $5bn via a 11NC10 bond at a yield of 5.015%, 25bp inside initial guidance of T+225bp area. The new bonds are priced at a new issue premium 5.5bp to its existing 2.972% 2033s, callable in 2032 that yield 4.96%.

The bonds have expected ratings of A2/A-/AA-. Proceeds will be used for general corporate purposes.

BNY Mellon raised $1.75bn via a 2-tranche deal. It raised

- $1.25bn via a 4NC3 bond at a yield of 4.414%, 25bp inside initial guidance of T+145bp area.

- $500mn via a 8NC7 bond at a yield of 4.596%, 27bp inside initial guidance of T+175bp area.

The bonds have expected ratings of A1/A/AA-. Proceeds will be used for general corporate purposes.

TSMC Global raised $1bn via a dual-trancher. It raised

- $400mn via a 5Y bond at a yield of 4.386%, 25bp inside the initial guidance of T+150bp area. The new bonds are priced at a new issue premium of 25.6bp to its existing 3.875% 2027s that yield 4.13%.

- $600mn via a 10Y bond at a yield of 4.736%, 27bp inside the initial guidance of T+200bp area. The new bonds are priced at a new issue premium of 28.6bp to its existing 4.25% 2032s that yield 4.45%.

The bonds have expected ratings of Aa3/AA– (Moody’s/S&P). Proceeds will be used for general corporate purposes.

TD Bank raised $2bn via a 3Y covered bond (Term of the Day, explained below) at a yield of 3.815%, just 1bp inside the initial guidance of MS+80bp area. The bonds have expected ratings of Aaa.

New Bonds Pipeline

- Guangzhou Development hires for $ Sustainability bond

- Lotte Property hires for $ 3Y Green, Sustainability bond

- Busan Bank hires for $ Social bond

- Continuum Energy Aura hires for $ Green Bond

Rating Changes

- Moody’s downgrades Lloyds Banking Group’s senior unsecured debt ratings to A3 from A2, stable outlook maintained

- Moody’s downgrades Sharjah’s ratings to Ba1, changes outlook to stable

- Fitch Revises Pakistan’s Outlook to Negative; Affirms at ‘B-‘

- Kohl’s Corp. Outlook Revised To Negative On Softening Consumer Spending; Ratings Affirmed

Term of the Day

Covered Bond

Covered bonds are senior secured debt instruments that are typically issued by banks. These bonds are secured (i.e. covered) by a pool of assets referred to as the “cover pool”, which typically consists of mortgages or loans. In an event that the bank defaults, holders of covered bonds have a preferential claim to the cover pool, which ensures interest payments and repayment of principal. This makes covered bonds relatively more secure vs. other debt and therefore results in a higher credit rating. While they have similarities with Mortgage-Backed Securities (MBS) in terms of the pool of assets there is a difference – the transfer of mortgages to an Special Purpose Entity (SPE) in a MBS issue means that the issuing bank no longer bears the risk of the loans and the mortgage pool is static. This is in contrast to Covered Bonds where, because the mortgage pool is constantly adjusted to maintain the pool size, the issuing bank bears the credit risk of the mortgages.

Talking Heads

On BOE Considering a Half-Point Rate Hike in August – BOE’s Governor Andrew Bailey

“This means that a 50 basis-point increase will be among the choices on the table when we next meet. 50 basis points is not locked in, and anyone who predicts that is doing so based on their own view.”

“Debt relief is of major importance for the world because the interest rates are going up. The debt was already too burdensome and now the countries are experiencing currency depreciation, which causes inflation… There’s not really a process to reduce that debt. We saw that at the G-20 just completed last week — no forward progress… “I’m hopeful that Zambia may be able to get debt relief in the next few days”

On Xi Facing Surprise Revolt From Chinese Homebuyers on Mortgage Boycott

Alfred Wu, an associate professor at the NUS

“Chinese homebuyers usually pool the whole family’s resources to buy a home. It is a life-and-death matter for them if their homes become negative assets.”

Chi Lo, senior Asia Pacific investment strategist at BNP Paribas Asset Management

“It’s the first time we’ve seen this type of mortgage boycott in China and it’s clearly caught Beijing’s eye. It’s crucial that Xi preserves stability before the 20th party congress… Not directly confronting the national regime has allowed these protests to continue up to this point”

On Morgan Stanley Talking About Buying Salvadoran Bonds Battered by Bitcoin Bet

“Markets are clearly pricing in a high probability of the autarky scenario in which El Salvador defaults, but there is no restructuring… For a restructuring to work, it nearly always needs the IMF involved and or there to be a clear push for reform by the government. Given this may not be the set-up in a potential restructuring, it could easily end up being a protracted negotiation.”

Top Gainers & Losers – 20-July-22*

Go back to Latest bond Market News

Related Posts: