This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

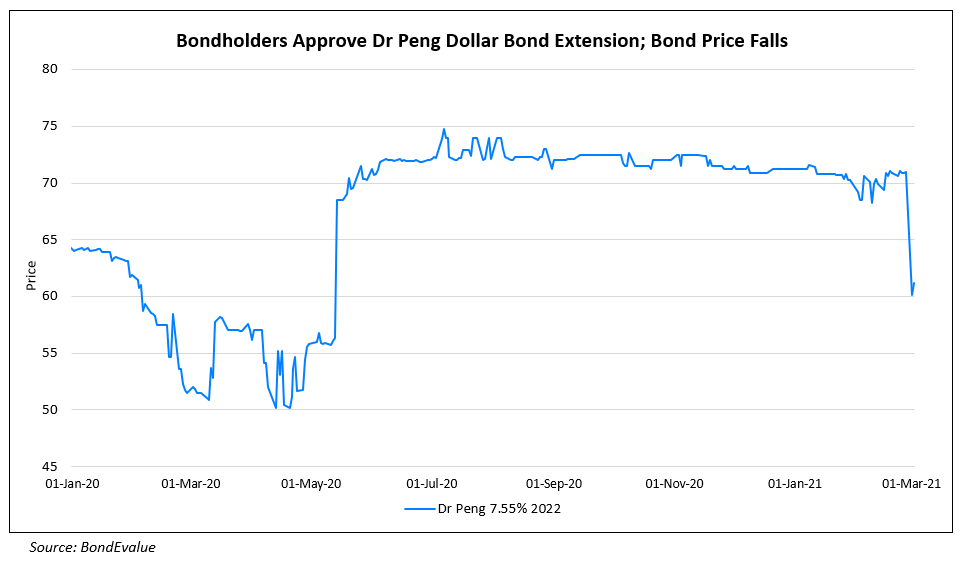

Dr. Peng’s 2022s Fall After Weak 1H Revenues

August 31, 2021

China’s Dr. Peng Telecom & Media Group reported profits for the six months ended June 30 came of RMB 1bn ($155mn), three times the profits of RMB 325mn ($50mn) earned in the same period last year, while earnings per share (EPS) rose to RMB 0.72 ($0.11), four times the EPS of RMB 0.18 ($0.03) in the first six months last year. Total borrowings decreased by 56% to RMB 566mn ($87.5mn). However, revenues fell 24.8% YoY to RMB 2.14bn ($331mn) and total cash balance were down 41% to RMB 649mn ($100mn). According to the financial report, the company is undergoing a strategic transformation to focus more on its cloud network business. After the change in focus, revenue from its cloud network business rose 143.71% to RMB 436mn ($67.4mn), accounting for over half of its total revenue, while revenues from its data centre and household broadband business fell 23% and 72% YoY to RMB 540mn ($83.5mn) and RMB 417mn ($64.5mn), accounting for 26% and 20% of total revenue respectively.

Its 7.55% 2022s have fallen by 2.1 points since Friday to 58.15, yielding 59.53%.

To read the full story, click here.

Go back to Latest bond Market News

Related Posts:

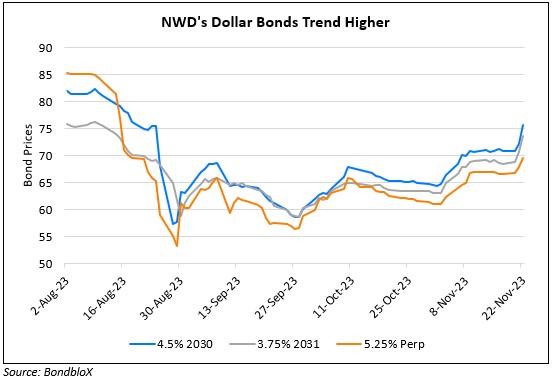

NWD’s Dollar Bonds Move Higher

November 22, 2023

NWD Dollar Bonds Rise

May 20, 2024