This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Credito Real’s Bonds Drop after Clarification on Credit Facility Commitment

January 27, 2022

Mexican lender Credito Real clarified that it is still working on getting a credit facility to pay $185.7mn in franc-denominated bonds due in 9 February. The announcement came after the company previously declared on its webpage that it had already secured a financing commitment of at least $120mn through a credit line. The statement has been removed from its webpage. Credito Real said that the company is continuing to work diligently on getting a credit facility and will give an update as soon as it has materialized. Credito Real was downgraded to B- by S&P two days ago.

Credito Real’s USD bonds were down with its 7.25% 2023s down 17 points to 57.7.

For the full story, click here

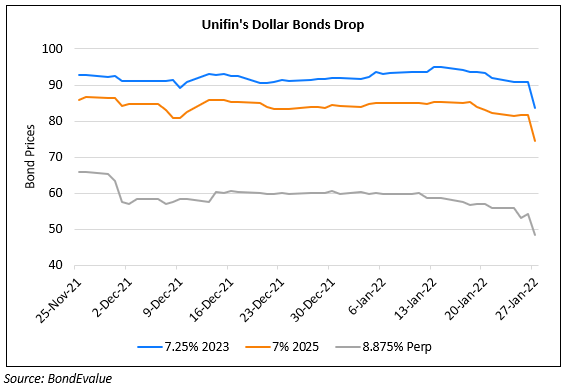

Separately, another Mexican financial services company Unifin Financiera’s saw its dollar bonds fall 4-8% on Wednesday. While the reason for the fall is not known, negative sentiment around Credito Real could have weighed on Unifin’s bonds.

Go back to Latest bond Market News

Related Posts: