This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

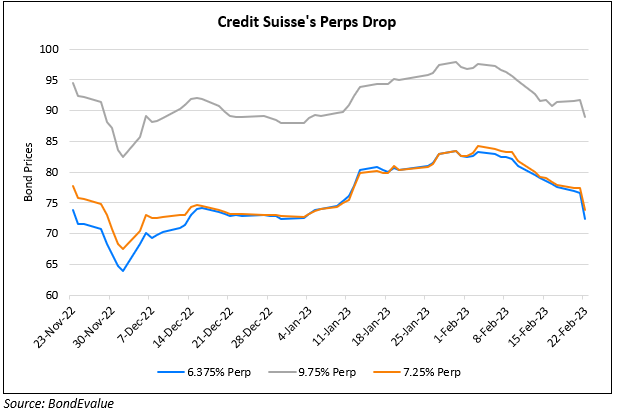

Credit Suisse’s Perps Drop After Swiss Regulator to Probe on Outflow Claims

February 22, 2023

Credit Suisse’s perpetual bonds/AT1s were down over 2-4 points after news broke out that the swiss financial markets regulator Finma was investigating the banks involvement in market manipulation. Credit Suisse Chairman Axel Lehmann’s commented on December 2 that outflows “basically have stopped”, just over a week after the group had disclosed an outflow of CHF 84bn ($90.8bn) of client assets on November 23. By the end of the quarter, the number rose to CHF 110.5bn ($119.2bn). Moreover, the comments were made before the completion of its $4bn capital raise that helped arrest the decline in its stock and bond prices. Bloomberg notes that the CEO Ulrich Koerner recently told analysts on a call that more than 85% of the outflows came in October and November, implying that ~CHF 17bn ($18.3bn) of outflows were seen in December after Lehmann’s remarks. Credit Suisse’s shares closed lower by 4%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: