This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

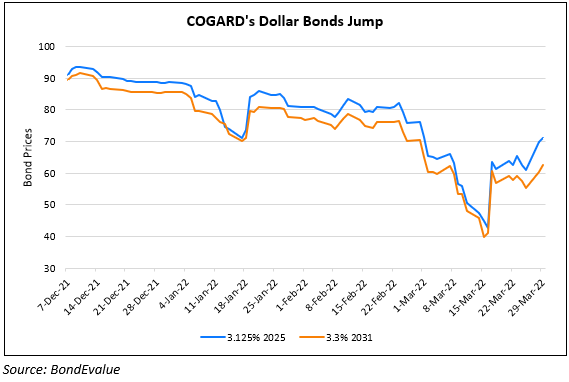

Country Garden’s Dollar Bonds Rally after $5.5bn in Loans and $6bn Facility from AgBank

March 29, 2022

Country Garden’s (COGARD) dollar bonds jumped as much as 14% after news that it secured loan quotas from AgBank and China Merchants Bank (CMB). Shanghai Securities News initally reported that COGARD entered a loan facility of RMB 20bn ($3.14bn) with the AgBank of China’s Guangdong Branch. Bloomberg however notes that according to an exchange filing, COGARD secured an RMB 40bn ($6.3bn) facility AgBank’s Guangdong Branch. They add that COGARD also also got a $2.36bn loan from CMB. The loans will be used for property merger and acquisition, as well as affordable rental housing and personal housing mortgage loan businesses.

Go back to Latest bond Market News

Related Posts: