This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Country Garden Secures $2.4bn Financing Deal

March 9, 2022

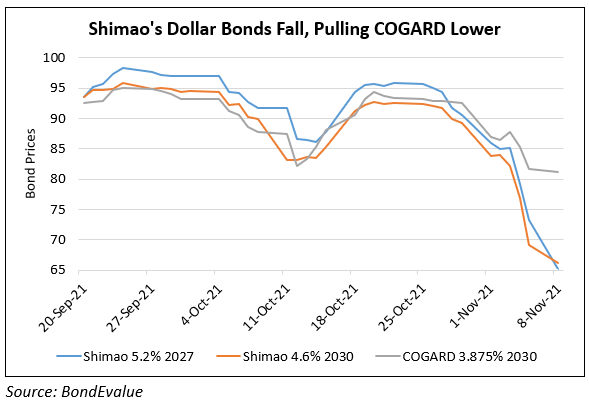

Country Garden (COGARD) and China Merchants Bank (CMB) have entered into a “property merger and acquisition financing strategic cooperation agreement”. CMB will grant COGARD RMB 15bn ($2.4bn) for the latter’s property M&A business. Another property developer, Midea Real Estate said that they secured a similar deal from CMB worth RMB 6bn ($950mn). These come after Chinese authorities in December eased limits on borrowing by major property firms used to fund M&A in an effort to alleviate risks in the property sector.

Country Garden’s dollar bonds were trading weaker, with its 5.625% 2030s down 2.2 points to 60.25.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Country Garden Plans to Raise $1.03bn via Share Sale

November 19, 2021

Country Garden Raises ~$500mn via HKD Convertible Bond

January 21, 2022