This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Country Garden Raises ~$500mn via HKD Convertible Bond

January 21, 2022

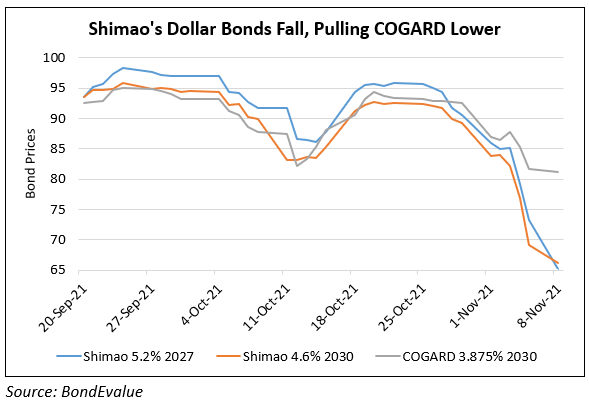

Country Garden (COGARD) raised HKD 3.9bn ($500mn) via a 4.95% convertible bond due 2026, guaranteed by Smart International Insight Ltd. COGARD (BB+/Baa3/BBB-), is among the few IG-rated developers in China and Bloomberg reports that it has has become a proxy for financial contagion. The pricing of the convertible bond signaled its ability to access funding markets and comes close on the heels of reports last week that indicated COGARD failing to generate sufficient investor demand for a potential $300mn convertible bond. The developer also said its $425mn 7.125% bond due January 27 will be repaid with internal resources. Overall it has $1.1bn of dollar bonds due in 2022 with reported cash balances of $22bn end-June 2021. Its dollar bonds are slightly higher today with its 5.625% 2026 up 0.8 points to 85.78, yielding 9.3%.

For the exchange filing, click here

Go back to Latest bond Market News

Related Posts:

Country Garden Plans to Raise $1.03bn via Share Sale

November 19, 2021