This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

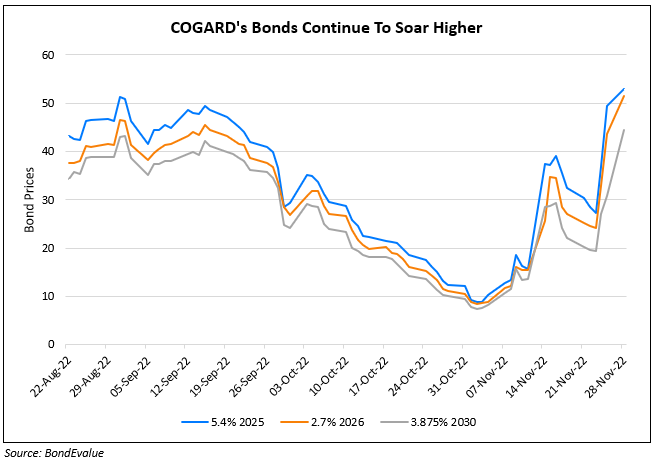

COGARD’s Bonds Continue to Surge Higher on New Credit Lines

November 28, 2022

Country Garden’s (COGARD) dollar bonds continued the move from last week to surge higher again as the developer received funding in the form of credit lines. Up to $7bn in credit lines were signed between COGARD and Postal Savings Bank of China which will be used for loans for land development, M&A, and mortgage financing. Besides COGARD also among a list of 12 developers that will receive $91.5bn in credit lines from ICBC. While dollar bonds across the developers’ space have seen a rally, COGARD has seen the biggest move having traded at ~20 cents on the dollar earlier this month despite its relatively stable operations and higher credit ratings (rated Ba2/BB- by Moody’s/Fitch) among high yield names.

Go back to Latest bond Market News

Related Posts: