This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

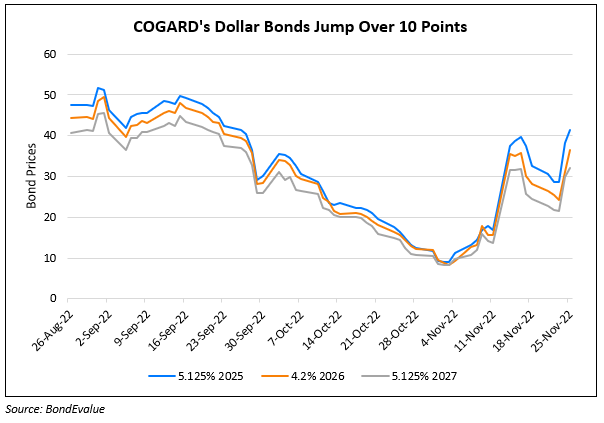

COGARD Warns of $1bn Loss for 2022; Bonds Trend Lower

March 14, 2023

Dollar bonds of Country Garden (COGARD) trended lower by 1.0-1.5% across the curve yesterday. As per an HKEX filing, the Chinese developer announced an expected loss attributable to shareholders of RMB 5.5-7.5bn ($800mn-$1.09bn) for 2022. Despite being the market leader with RMB 464.3bn ($67.6bn) of sales in 2022, this will be the first time since 2007 that COGARD reports a full-year loss. The developer also stated that the company has managed to keep its net debt ratio low while maintaining a healthy credit record. This comes after COGARD raised a total of HK$8.61bn ($1.1bn) through two stock placements in November and December last year.

COGARD’s dollar bonds are trading 4-6 points lower since last week with its 8% bonds due January 2024 at 84.19 to yield 30.2%.

-2.png)

For more details, click here

Go back to Latest bond Market News

Related Posts: