This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

COGARD Leads Chinese Developers Bond Rally on Large Credit Lines by Domestic Big Banks

November 25, 2022

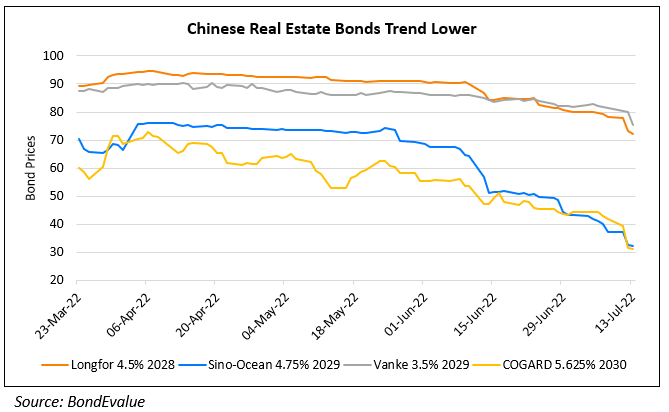

Dollar bonds of several Chinese developers rallied after ICBC, Postal Savings Bank of China and CCB joined three other big domestic banks in providing a combined $129bn in credit lines.

- ICBC said it would provide RMB 655bn ($91.5bn) in credit lines to 12 developers namely, China Vanke, Gemdale, Greentown China, Longfor, COGARD, Midea, Radiance Holdings, CHIOLI, Poly Developments, China Resources Land, China Merchants Shekou, Shenzhen Overseas Chinese Town

- Postal Savings Bank will extend an RMB 280bn ($39.1bn) credit line to COGARD, Vanke, Longfor, Greentown, Midea

- CCB will extend a credit line (undisclosed amount) to Vanke, Longfor, Midea, China Communications Construction, Yuexiu, Beijing Capital Development, Dahua Group, Hopson

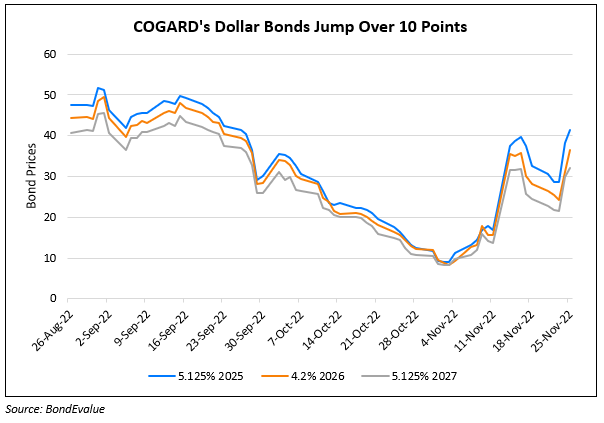

Li Kai, founder of Beijing Shengao Fund Management said, “The core of the policy is to build a firewall between developers that have already defaulted and those that haven’t”. While all of the above developers’ bonds rallied by over 1-2 points, COGARD’s dollar bonds saw a sharp rise by over 10 points.

Go back to Latest bond Market News

Related Posts: